Some 81% of long-stay nursing home residents are dually eligible for Medicaid and Medicare coverage, yet the facilities they call home have rarely played a role in providing their health insurance.

But analysts at healthcare research and consulting firm ATI and the SNP Alliance say an approaching regulatory transition presents a key opportunity for more skilled nursing providers to participate in and potentially offer special needs plans designed for dual-eligible individuals.

“Much of the policy debate around Medicaid and Medicare integration focuses on individuals living in the home or living in the community, and we need to do a better job thinking about integration’s role for individuals living in nursing facilities,” said Allison Rizer, ATI principal and lead of the firm’s Medicare-Medicaid Integration and LTSS Innovations practice.

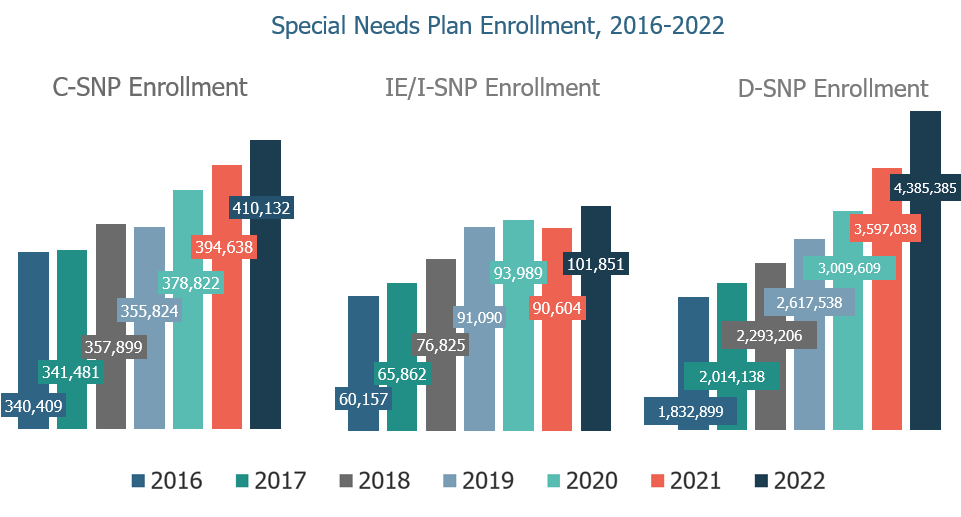

Rizer and ATI senior analyst Cleo Kordomenos authored a November report examining ways states can blend successful elements of the Medicare-Medicaid Plan model into quickly growing Dual-Eligible Special Needs Plans, or D-SNPs. D-SNPs are the largest of the special needs plans, covering about 4.4 million of more than 11 million dually eligible beneficiaries.

The MMP model will sunset in 2025, the Centers for Medicare & Medicaid Services announced in its 2023 Medicare Advantage and Part D final rule. CMS is putting all of its dual-eligible support behind D-SNPs, and ATI is urging the adoption of policies and flexibilities to drive plan improvements.

Rizer sees state strategies that better emphasize inclusion of and care designed for SNF-dwelling dual-eligibles as one key need.

“There’s a policy opportunity to think specifically about those individuals who live in the nursing facility,” Rizer told McKnight’s Long-Term Care News last week. “States are aware of this and thinking about it. CMS is aware of this and thinking about it … All of that in my mind means there’s opportunity moving forward.”

There were more than 800 D-SNP options this year, up from 551 in 2020.

As was the case with Institutional Special Needs Plans, or I-SNPs, not long ago, nearly all D-SNPs are currently offered by major insurance providers and managed care companies. But there is the potential of financial reward for providers who can stomach the risk that comes with being an insurer and managing participants’ quality outcomes.

While I-SNPs are contained within a facility or facilities, provider-led D-SNPs would cater to dual-eligible patients who may very well still live in the community.

That presents its own hurdles, but providers might be tempted to venture into providing their own plans if the right incentives and contractual requirements are offered. Those providers best-positioned to enter the D-SNP market likely have had experience either with I-SNPs, similar plans for assisted living communities, or PACE programs, Rizer said.

American Health Plans is a quickly growing I-SNP provider whose model includes integrated nurse practitioner and case management services provided by partner TruHealth.

Hank Watson, chief development officer for American Health Partners, the parent company of American Health Plans, said considering ways to extend that care to serve additional patients beyond the nursing home and in the community “may make sense.” The company is exploring possibilities with D-SNPs, Institutional Equivalent SNPs, Chronic Condition SNPs and other Medicare Advantage plans.

“It’s part of the untapped potential of the I-SNP as a stand-alone product, but also as a base to develop other products in the community,” Watson said this week. “If TruHealth already has nurse practitioners servicing nursing home residents in a rural community – then it may make sense to have those same providers support members in other senior housing communities that would otherwise be hard to reach.”

States in need of D-SNP guidance

Through the upcoming transition, states could adopt policies that make it more attractive for nursing homes to sign on as participants, but CMS must provide the right guidance, Rizer said.

States could drive value for nursing home participants by ensuring contracts promote value-based incentives. Unlike I-SNPs, states with D-SNPs can shape coverage through the use of required State Medicaid Agency Contracts. Such contracts could begin to call for I-SNP like clinical models, or incentivize payments through a value-based care approach.

A state, for example, could require its DNPs to develop a value-based model specifically with skilled and long-stay nursing facilities in mind, which Rizer said is a tool that could be used to advance quality care and outcomes in a nursing facility.

Integrated plans could also help address workforce shortages by bringing more resources than Medicaid coverage alone; approaches could include paying bonuses to facilities that provide certain staff training or ratios or demonstrate their ability to retain employees in key roles.

But states will need more guidance, including best practices and sample language, from CMS to aid them as they target nursing home dual-eligibles and others for inclusion.

“So much of the DSNP environment is tied to a state’s priorities,” Rizer said. “So if you have a state that is very focused on local delivery of care and local organizations that can be risk-bearing organizations, those are states where I see particular opportunity for provider organizations to stand up D-SNPs.”