Medicare Advantage’s explosive growth means ever-more pressure for skilled nursing operators, but five-year enrollment data reveals many skilled nursing operators are doing their best to wrest some control.

Growth in Institutional-Special Needs Plans accelerated significantly between May 2017 and May 2022, according to a Health Dimensions Group analysis of MA statistics. I-SNPs provide additional services to SNFs and reward providers who hit quality benchmarks with incentive payments.

That’s the opposite experience many providers say they’ve had with mass market MA plans, which have been plagued by reports of pre-approvals, rampant denials and payments lower than those from traditional Medicare.

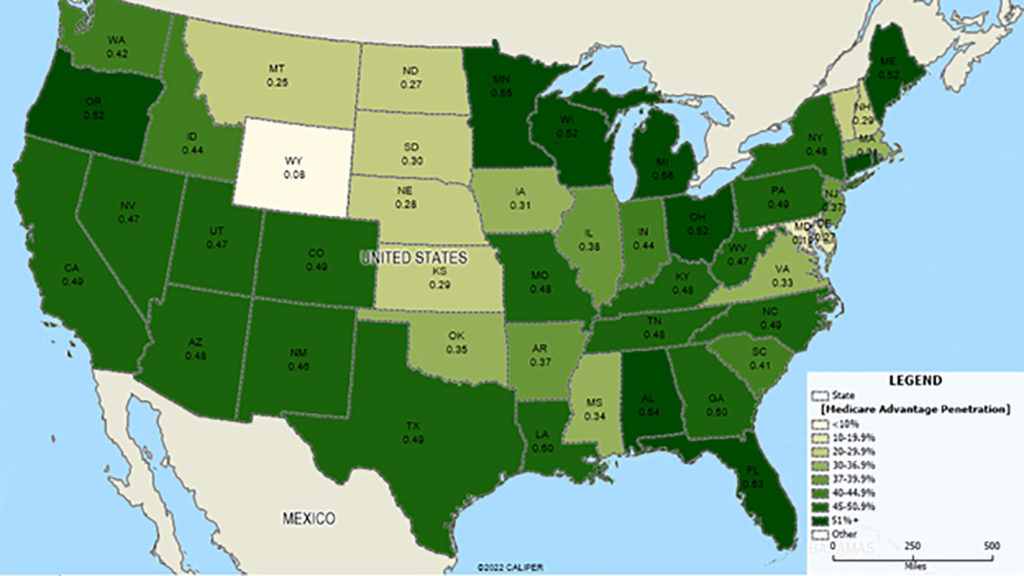

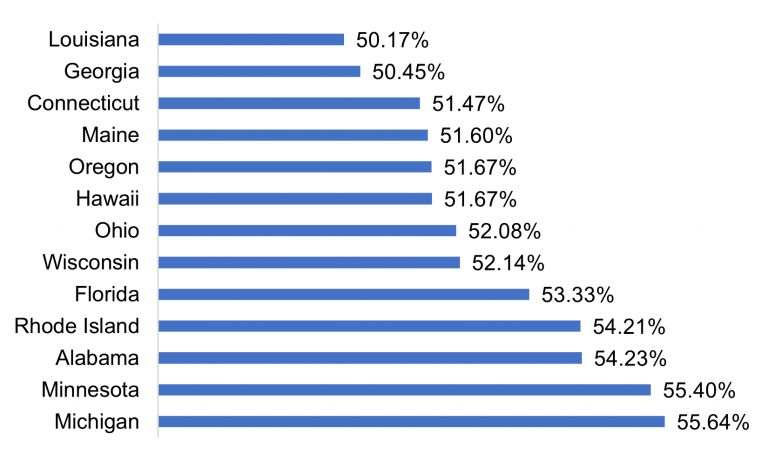

Overall, average penetration for all types of MA plans now sits at 46% nationally, but ranges from a low of 1.8% in Alaska to a high of 56% in Michigan. As of May, 13 states have enrollment higher than 50%. Another seven states have between 48% and 50% penetration, with HDG predicting they will likely exceed 50% within the next one to two years.

That strong consumer preference comes with potential downsides, but some possible upsides too.

“The growth of Medicare Advantage has several immediate implications for providers,” wrote HDG’s Colin Higgins and Brian Ellsworth in the analysis, which was released Friday. “Medicare Advantage plans can be stingy with authorizations and sometimes have lower payment rates than [traditional Medicare]. The proliferation of plans can mean increased fragmentation for providers, as some plans use unique payment structures and have differing policies. On the plus side, plans can be flexible, covering things like telehealth and providing supplemental benefits.”

Special needs, special growth

One data point that may work in the provider’s favor: The number of I-SNP plans has accelerated faster than any other type of special need plan, with 125% more plans in five years and a 53% jump in enrollment.

In some ways, that has made market expansion easier for I-SNP managers.

Half of the states where American Health Plans operates are above the national average of 46% and others, including Mississippi, are fast-growing. In Georgia, where the company has a “significant” I-SNP presence, overall MA penetration is now at 50.45%.

“Serving these fast-growing states tends to make I-SNP adoption more palatable, as the providers have dealt with the oversight of non-provider owned Medicare Advantage and understand there is value in owning and controlling the Medicare Advantage Model of Care and premium dollar for their residents,” said Hank Watson, chief development officer for Tennessee-based American Health Plans. “There is more education necessary when Medicare Advantage is not as prevalent, though it is now so ubiquitous that most providers are adept at understanding the value of a provider-owned plan.”

Searching for value

Watson said the pressure of high MA penetration can drive interest in I-SNPs, especially as more providers come to realize that Fee-for-Service Medicare “is disappearing.”

“Operators see I-SNP ownership as a proactive measure to control their own destiny and a strategy to stop ceding control of the model of care to large payers,” Watson said, noting that smaller I-SNP players that know their local markets are also gaining a foothold in the segment. “The growth is almost all in new entrants and provider-owned plans. Since 2017, the large incumbent (Optum/UHC) has grown 13%, while everyone else has grown almost 200%.”

American Health Plans grew more than 2,000% over the last five years, adding about 1,000 new members every six months, Watson said.

The HDG authors included I-SNP participation, possibly in a consortium with other providers, as one of several tips for skilled nursing providers trying to navigate the quickly changing landscape.

“At a minimum, consider value-based arrangements whereby the strengths of your organization can be leveraged to improve quality and lower costs, and you share in the rewards,” they wrote.

Among their other suggestions for dealing with any MA plan were to frequently review contracts and try to remove “onerous” provisions; to widen contract coverage to ensure they can accept patients from all plans in a given market.

“You cannot afford to be turning down viable payors,” they said. “Approach plans with an outcome focus and try to find the win-win by managing the whole episode of care.”