(Second in a series on providers’ attitudes and concerns about operating conditions in 2023.)

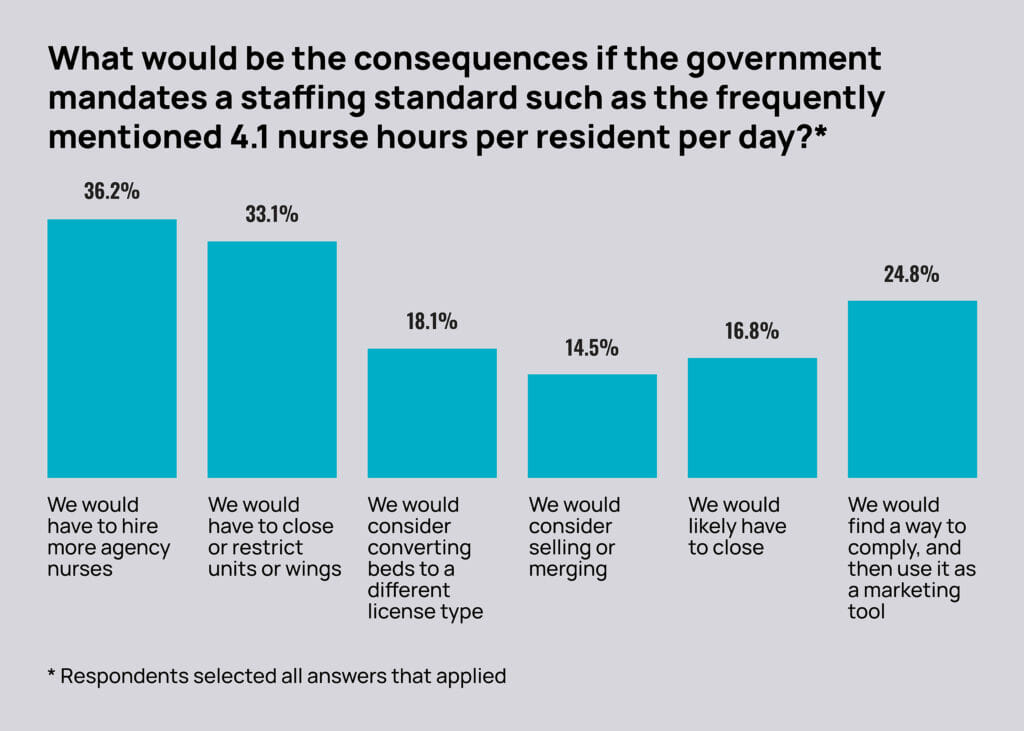

Half of all nursing home providers and building leaders (49.8%) surveyed by McKnight’s Long-Term Care News said they would have to close in part or in full if federal regulators adopt a 4.1-hour nurse staffing mandate in 2023.

Among facility owners, C-suite executives and administrators, the predicted closure threat rose to 54.4%. Nearly 41% of that group also said they would have to hire more agency staff if that rigorous mandate is imposed.

Those warnings came as part of McKnight’s 2023 Outlook Survey, which asked a series of questions about key staffing metrics and strategies after a year of unprecedented labor challenges.

“If it’s unfunded, all a mandate would do is cause communities to have to reach out to agencies or contract staff to meet that minimum,” predicted long-term care recruiter Katie Piperata. “You might have more nurses in the building, but you can’t guarantee they’re going to be committed and have a stake in the product. If you make that a mandate, it’s only going to decrease quality because we don’t have the people.”

McKnight’s Long-Term Care News garnered just short of 1,000 responses from nursing home owners, C-suite leaders, administrators and nurse supervisors for its annual year-end survey. This year’s edition was conducted by email from Nov. 22 to Dec. 9.

Results showed that many individuals running nursing homes believe they are turning the corner on extensive agency use. Last year, just 10% of respondents said they expected to reduce the use of agency staff in 2022. But in the 2023 Outlook survey, 33% predicted they would use less in the year ahead.

And far fewer respondents than last year (4.7%) said they “don’t” or “won’t” use agency. That’s far fewer than the quarter (24.6%) who said this year that they don’t use agency at all.

Skilled nursing experts said that significantly increased participation in the McKnight’s survey this year might mean it better represents geographic pockets with intransigent staffing problems.

It also could reflect a shifting stance in anticipation of the staffing mandate expected from the Centers for Medicare & Medicaid Services early in 2023.

More than one-third of respondents (36.2%) said they would have to hire more agency nurses if a mandate were to require 4.1 nursing hours per resident per day. That figure rose to 40.6% among administrators, C-suite decision makers and owners.

Survey shows signs of staffing rebound

Overall, staffing remains a major concern, though not quite as ubiquitously as last year’s findings revealed. In the 2022 outlook survey, 94% of respondents chose staffing as one of their top two non-COVID challenges for the year ahead. That share fell to 42% in this year’s survey. Owners and administrators (45%), as a group, were slightly more concerned than their nursing counterparts.

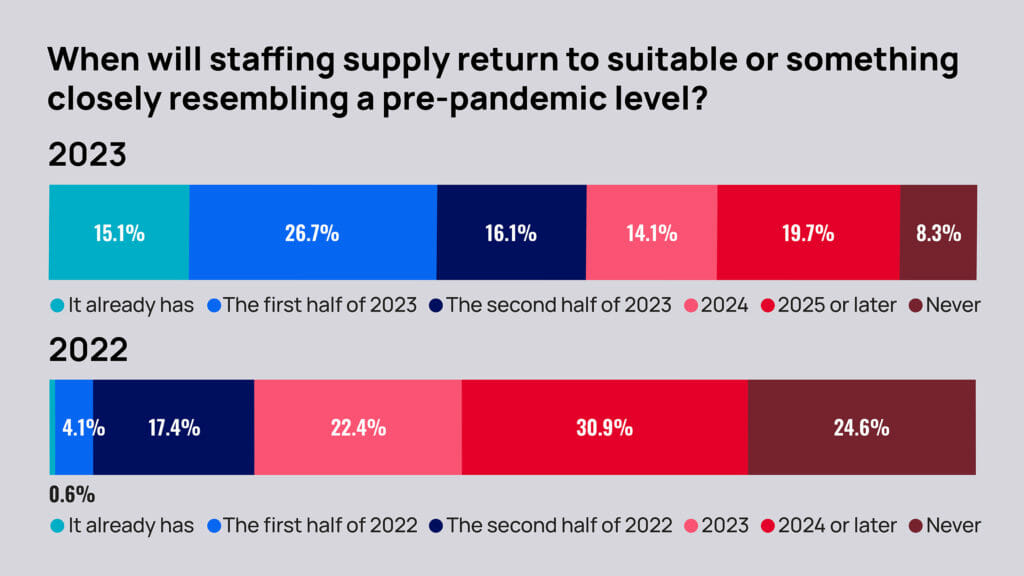

Some 58% of respondents also said staffing had already returned to “suitable” levels or “something closely resembling a pre-pandemic level” or would do so by the end of 2023. That’s up from last year’s 22% who thought staffing levels would rebound by the end of 2022.

Also on the staffing front, fewer respondents said they had to curtail admissions due to staffing and/or other COVID-related challenges in 2022. About 69% said they had to do so in 2022, down from 72.6% reporting the same for 2021.

Conversely, the proportion who foresee having to restrict admissions at any point in 2023 due to staffing or COVID in 2023 (67%) actually went up over projections for 2022 (57%). When asked specifically about their response to the staffing mandate, 33% said they would have to close or restrict beds or units. And 17% said they would “likely have to close.”

But Bob Lane, president and CEO of the American College of Health Care Administrators, thinks the numbers of projected closures may have come in too high, reflecting frustration and fears around the timing of CMS’s staffing mandate pursuit.

“The 4.1 would be crippling, very much so, for a lot of smaller providers that are single owner or the ones that don’t really have a level of support from a multi-site organization that can shift resources around,” he said. “Closing altogether? I think that is a reality for some rural providers, but I think it’s more likely to see the beds contracting a little bit.”

THURSDAY: Providers share worrisome expectations for 2023 mergers and acquisitions

PREVIOUSLY: Spiraling costs threaten growing optimism for skilled nursing in 2023 Outlook Survey