(First in a series on providers’ attitudes and concerns about operating conditions in 2023.)

Optimism for the skilled nursing sector is growing, with intense worries about staff shortages and less-than-desired occupancy starting to recede. But concerns about escalating financial pressures have swiftly moved into the void, according to findings from the McKnight’s 2023 Outlook Survey.

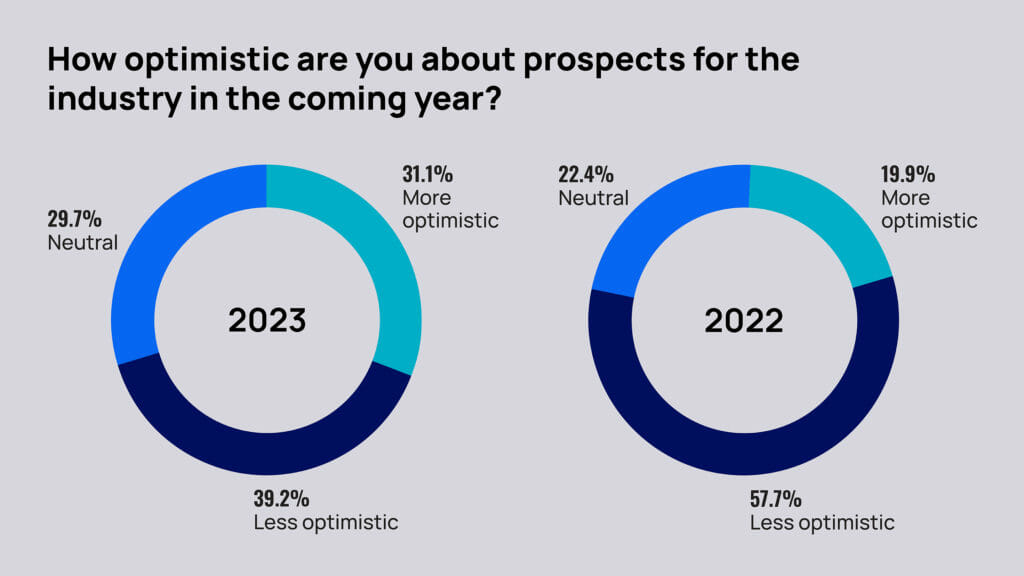

Thirty-one percent of all respondents said they were more optimistic about prospects for the industry in the coming year, up from just under 20% in the 2022 survey. The share that reported feeling less optimistic dropped from 57.7% in 2022 to 39.2% in 2023.

The decreased pessimism tracked across categories, from nursing supervisors to owners.

“Optimism is on the uptick, but it’s a guarded optimism, I think,” said Bob Lane, president and CEO of the American College of Health Care Administrators. “With this administration, you never know what they’re going to pull out of their pocket next and throw at us.”

McKnight’s Long-Term Care News garnered just under 1,000 responses from nursing home owners, C-suite leaders, administrators and nurse supervisors for its annual year-end survey. This year’s edition was conducted by email between Nov. 22 and Dec. 9.

Participation tripled over last year, when the staffing crisis was crystallizing and many facilities were facing new COVID outbreaks fueled by the emerging omicron variant.

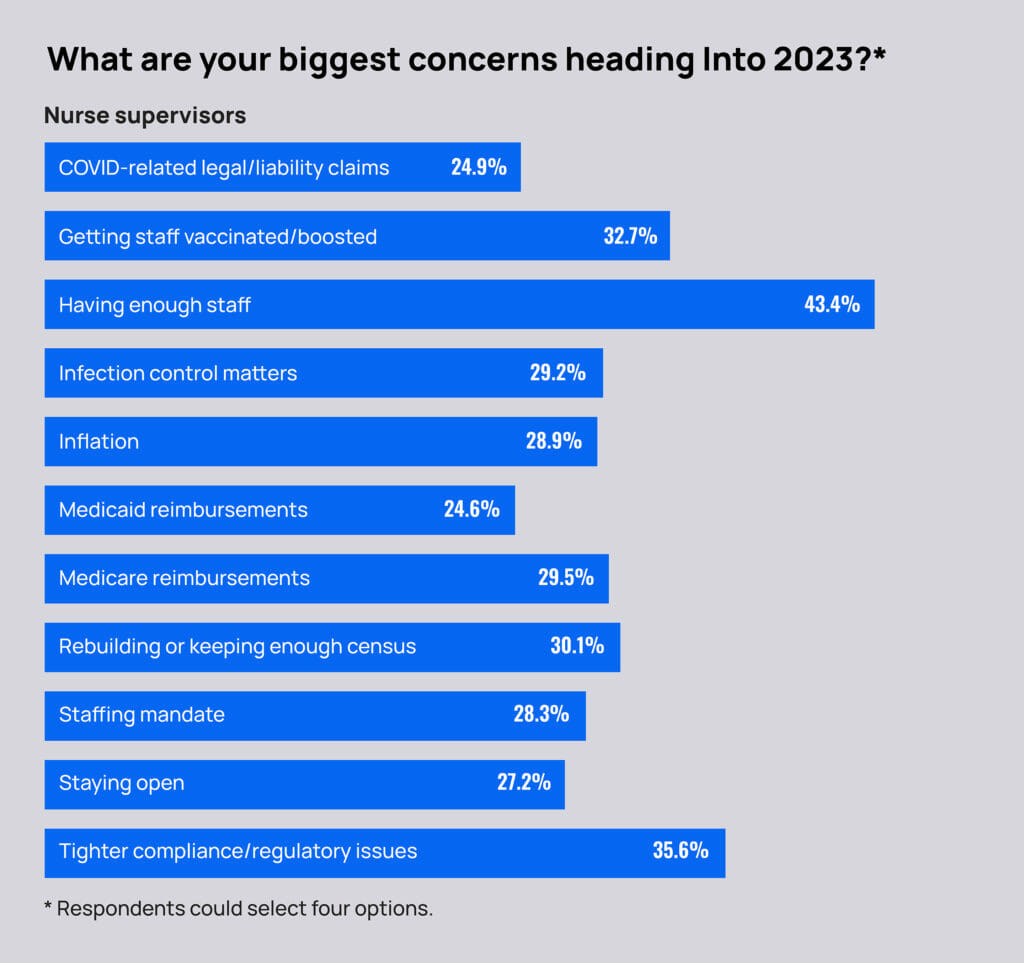

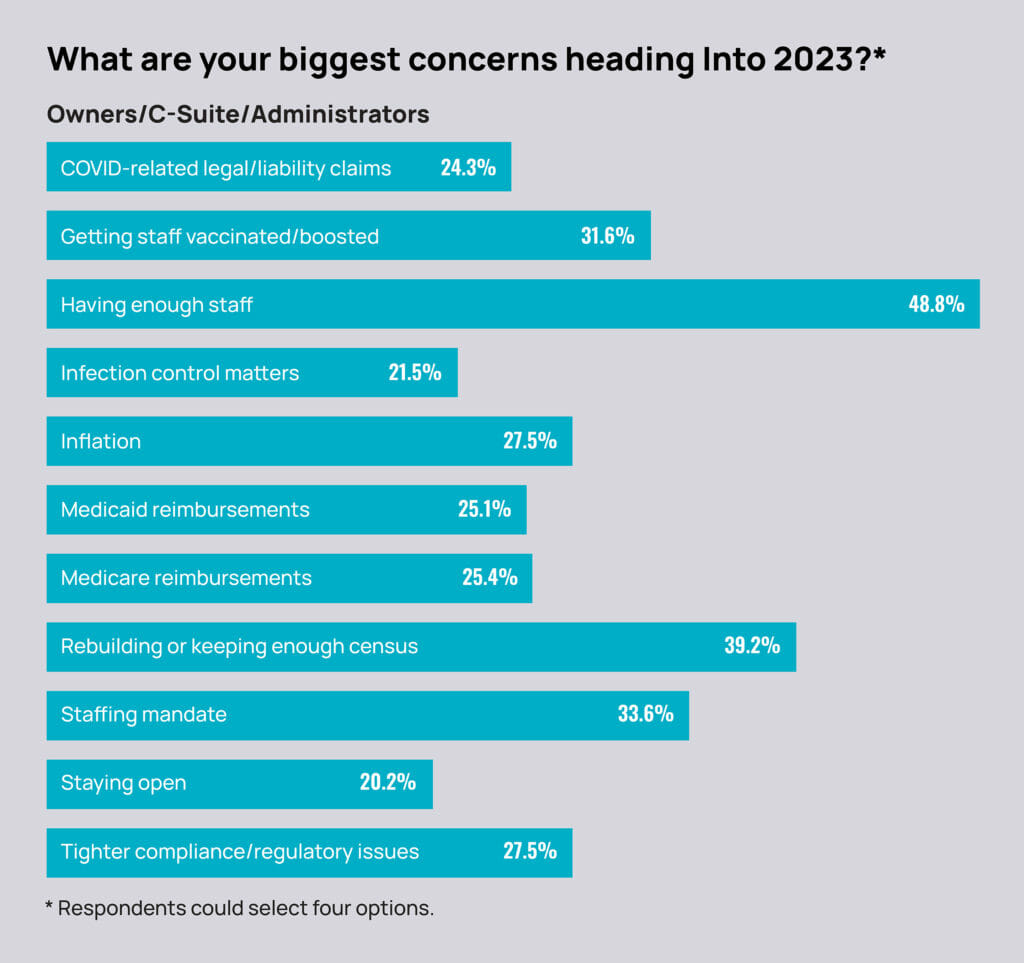

This year, many of those who work in and run nursing homes are reporting a somewhat brighter outlook and putting less emphasis on COVID-related concerns such as vaccinations and infection control.

Still, the ongoing pandemic and the potential end of the federal public health emergency are influencing providers’ actions and attitudes, said Katie Piperata, a workforce architect and former nursing home administrator who recruits for long-term care search firm MedBest.

“Because a lot of the COVID resources are going away, a lot of providers are just trying to figure out how they will make ends meet,” Piperata told McKnight’s. “Their profit margins, their true profit margins without all the COVID assistance, are now worse than they ever were because the margins are so slim, if any. I don’t see a whole lot of my clients feeling better because now they’re just feeling the true outcome of all of this.”

Inflation, rising costs cut into positive outlook

Broad inflation in the US economy, coupled with explosive wage hikes that won’t revert as COVID conditions wane, are putting financial sustainability front and center, Pipereta added.

The McKnight’s results bear that observation out.

Where 94% of respondents last year picked staffing as one of their top two non-COVID concerns for 2022, that fell to just 42% in the survey for 2023. Occupancy, in second place at 44% in the 2022 survey, fell into fifth place with 36% selecting it as a top concern for 2023.

For 2023, concerns among the entire responding group grew overall with the regulatory and surveying environment (42%), Medicare and Medicaid payments (40%) and inflation (36%). Among the owners, C-suite and administrators, however, 42% chose inflation as a major non-COVID concern.

“There doesn’t seem to be an end in sight in terms of the upward spiral of cost, and obviously the payment systems, especially Medicaid, have rarely if ever kept pace,” Lane said. “With wages skyrocketing and the added overall inflationary pressures of everything else going up, you start looking at single items — medical supplies or medications — and they’re going up more than 8 or 9%.”

Lane noted that one help late in 2022 was some perceived staffing relief and connected increases in census, both of which add more cash flow.

Among 633 owners, executives and administrators who responded to the McKnight’s Outlook Survey, 71% said they had already arrived at pre-pandemic census levels or expected to get back there sometime in 2023. Overall, 68% of respondents expect full census recovery by this year’s end; last year, just under 50% expected that kind of recovery by the end of 2022.

Occupancy, job satisfaction reality

But that optimism may not be truly reflective of national conditions, said Bill Kauffman, principal with the National Investment Center for Seniors Housing & Care. Overall, even in the nation’s top 31 metro markets, occupancy of free-standing SNFs sat at 79% in the third quarter of 2022, according to NIC Map Vision data. That’s more than 6% below the pre-COVID standard of 86.3% in those same markets.

“The skilled nursing industry is just highly fragmented, so if you’re capturing certain properties in certain areas, or certain industry folks working in certain areas, then they could see occupancy doing OK,” Kauffman said. “But the No. 1 concern that we’ve heard, still, is the staffing crisis. For some operators across the country, that is a direct correlation with occupancy levels.They can have the demand with hospitals wanting to refer skilled nursing patients, but they just can’t accept them.”

Despite still-arduous working conditions and persistent financial pressure — especially where staff shortages exist — both nurses and administrators reported more job satisfaction in the 2023 survey.

When asked how they rate their current level of job contentment, 1 being the lowest and 10 being the highest, 298 administrators averaged a rating of 7.3, up from a 5.6 last year. Nurses’ ratings went from a 5.5 average last year to a 7.3 in the 2023 survey.

Those feeling most optimistic about the sector’s future may be inspired by conditions that lead to improved job satisfaction numbers, Kauffman said.

“You have a divide of operators. If you’re a very good operator in terms of knowing how to manage the staff, creating a culture that the staff is satisfied with and continually improving that, and also producing great quality care within your marketplace, then you can be doing well, and you will do well,” he said.

Coming Wednesday: Respondents’ outlook on the possible impacts of a federal staffing mandate, continued admissions limits and the changing role of agency.