Far fewer nursing home owners and administrators see a definite sale or merger in 2024, but that could easily change as financial and operational uncertainty continue to dog the sector’s decision-makers.

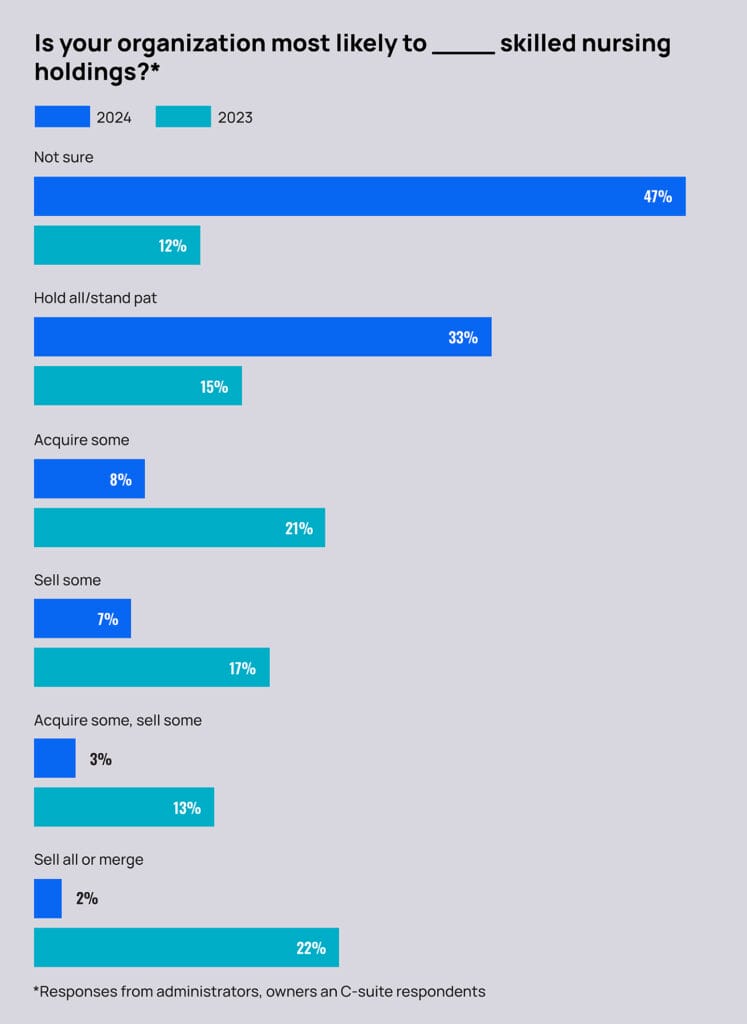

Some 47% of skilled nursing leaders participating in the McKnight’s 2024 Outlook Survey said they were uncertain whether they were more likely to sell, hold all or acquire facilities in the year ahead. Last year, just 12% chose “not sure,” with 39% indicating a partial sale, full sale or merger was likely.

This year, however, just 9% of leaders chose the combined sale or merger options. Experts told McKnight’s Long-Term Care News that could be a sign of easing financial pressures, slowing sale options or, more simply, the many unknowns providers will face this year.

Lisa McCracken, head of research and research analytics for the National Investment Center for Seniors Housing & Care called the 47% uncertain rate “puzzling” but conjectured that various economic realities could be factoring into the decision to hold off on those decisions.

“This has been playing out for several years now around selling, that sort of recalibrating and some of the downsizing,” McCracken said. “We know that’s been particularly true for some of the freestanding nursing homes. If that’s all you have is a 60-bed nursing home, that’s really tough. That type of community has slowly been rolling up and consolidating into larger platforms. … The question has been where will that slow down or potentially bottom out.”

McCracken said the trend of the last few years has a natural limit, and providers — especially those in the quickly trading continuing care retirement community business — may have reached it because they’re now filling more of the beds that remain.

“The likelihood of those same numbers and that same pace of sale and transaction activities is going to slow down,” she said. “Have they hit a spot where they’re saying they are comfortable with that right-sizing approach that they’ve taken the last several years and feel like that’s something that they can now maintain? They might be in a holding pattern.”

On the other hand, challenged providers may be remaining on the sidelines to see where valuations head this year. For some, however, time may be running out to make a deal while still operational. McCracken said that could influence valuations in 2024, if more financially strapped facilities come on the market with owners more willing to take lower purchase prices.

“There’s gonna be some forcing of narrowing there because people are going to be tired of sitting on things for an extended period of time,” McCracken added. “I think 2024 is going to be a very interesting year.”

Mixed signals on improvement

As with many of the queries in this year’s survey, lingering questions around a proposed federal staffing rule and its implementation timing are influencing providers’ strategizing, too.

The 2024 McKnight’s Outlook Survey drew 350 responses from skilled nursing owners, administrators, nurse leaders and other key professionals. It was administered online Dec. 1 through Dec. 28.

One-third of respondents said they would have to close units or wings of a facility if a proposed mandate to hire thousands more certified nurse aides and registered nurses comes to fruition. Another 8% said they “would consider selling or merging” at that point, while 7% said they “would likely have to close” their facility entirely.

“If any kind of mandate actually does find its way into regulation, that’s going to drive providers to close up,” predicted Bob Lane, president and CEO of the American College of Health Care Administrators, told McKnight’s. “We know that all of the studies have shown that the costs associated with this mandate are exorbitant.”

One factor that could help, Lane pointed out, would be lower interest rates. He called the Federal Reserve’s December decision to keep a key interest rate unchanged a “nugget of positivity.” The Fed has indicated that inflationary pressures are easing and that the job market was cooling and signaled that members may cut rates multiple times this year.

“I see that as a glimmer of hope,” Lane said. “Rising interest rates and operations costs hit everybody, whether it’s in your supply costs, your food costs, your labor costs. … When everything costs more, and it comes back to 85% of your revenue base is essentially paid through two government programs that aren’t keeping pace with those rises in cost, then it paints everyone into a corner.”

With the mandate hanging over their heads, providers continue to show strong interest in converting beds and taking them out of the nation’s skilled nursing inventory. Some 19% or providers said they’d choose that option if the mandate were finalized. That would continue a trend of shifting licenses from skilled care to assisted living, which has been especially notable in CCRCs.

“These are not organizations that are trying to buck any system by any stretch,” McCracken said, adding that many organizations are thinking about the future and where they may be able to provide somewhere less complex care with less cost and, possibly, less regulation.

“Where can you do that within a safe environment? As much as they can, that may be in a higher level assisted living with some additional supports,” she said. “That’s a less costly environment that may not have some of those obvious demands.”

Moving off the value-based sidelines

The continued escalation of inflation and wages amid more Medicaid uncertainty are also leading many provider leaders to consider new ways to improve financially.

Some 36% of administrators (and 40% of all respondents) said they will likely be more involved with specialty services such as dialysis, memory care or ventilator care this year.

That was followed by 28% of administrators (and 24% of all respondents) who said their facility would likely be more involved with accountable care organizations. This comes a year into the ACO Reach model, which has been billed as being more friendly to skilled nursing operators interested in taking on risk and earning rewards for the care they deliver.

“Organizations that were kind of sitting on the side lines in the years past that are now coming to the table and meaningfully engaging and value-based care,” Brian Fuller, managing director of ATI Advisory’s value-based care design and delivery practice. “We are of the mindset that no one will be left out and everyone involved in healthcare in their communities will need to and increasingly have a seat at the table with relevant value to contribute kind of to the overall achievement of value.”

The Centers for Medicare & Medicaid Services and its Center for Medicare & Medicaid Innovation is also increasing its commitment to better engaging specialists, including skilled nursing providers, in value-based care. Fullers said the idea of caring for senior patients as part of a broader population care management approach will accelerate in years ahead.

That makes it a prime time for those skilled nursing providers to get onboard, he said.

And if they’re not already thinking about care diversification and partnerships, McCracken said, this is the time to start.

“The nursing home environment, it’s not historically the same as what it’s been. You’ve got to be able to up your game and have different ancillary services or be at risk for payment. If you’re in [the sector], you’ve got to be able to operate at a certain level of sophistication, and I think all of these play into that.”

This is the last in a series on this year’s McKnight’s 2024 Outlook Survey. Previous installments revealed major staffing mandate concerns and a more pessimistic view of the sector’s future.