With occupancy and financial pressures mounting, nearly a third of long-term care executives are considering selling skilled assets in 2022 — making it likely this year will be another very busy deal-making period for the industry.

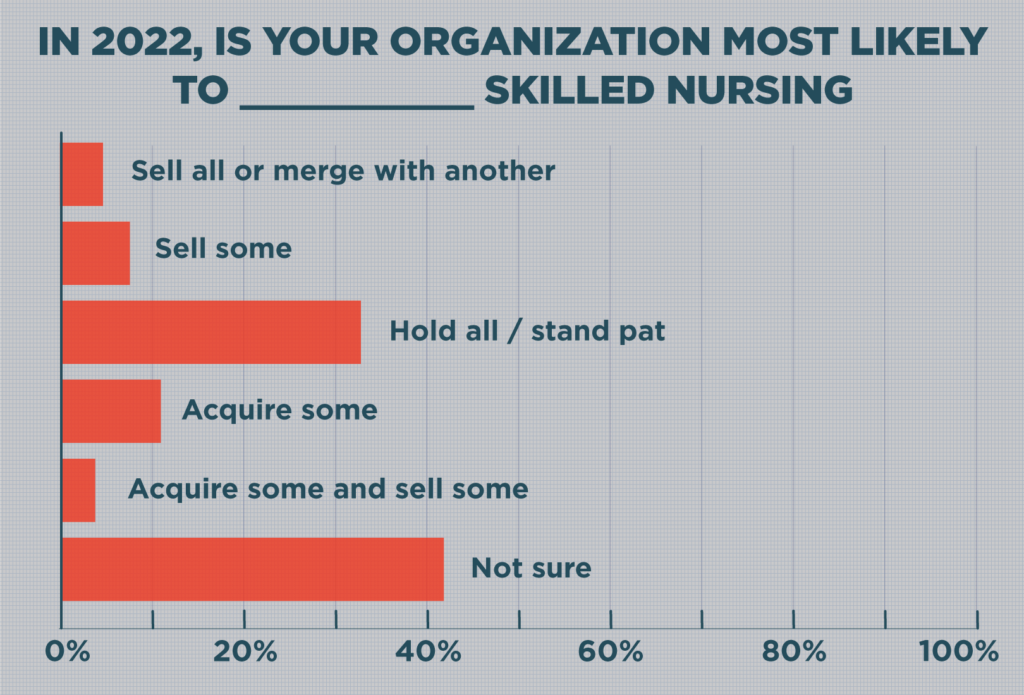

Just over 23% of CEOs in a new McKnight’s survey said they would “most likely” sell some of their skilled nursing holdings in 2022, with 7.7% saying they may sell all of their skilled settings or merge with another provider.

Meanwhile, another 34.6% planned to stand pat with all their properties, and 7.7% said they will be looking to acquire new skilled operations, while the remainder were unsure.

The combined 31% likely to sell “ certainly ‘feels’ right,” said Laca Wong-Hammond, managing director and head of mergers and acquisitions at Lument, citing “one of the strongest pipelines of all time.”

Protecting downside risk

Some organizations’ plans to divest may reflect increasing financial pressures also captured in the McKnight’s 2022 Outlook Survey. Reimbursement and inflation ranked among providers’ main concerns. The survey was completed by 317 nursing home owners, executives, administrators and nurse leaders via email between Dec. 10 and Dec. 30.

Results reflect the ongoing stresses of COVID-19 and dire staffing shortages, said Ryan Cochran, leader of the finance and restructuring practice at the Nashville-based Waller law firm.

“It’s been two years of pressure now. In some respects, that can just be exhausting,” Cochran told McKnight’s. “There may be some CEOs who feel like they’ve endured enough of the uncertainty caused by the pandemic and they’re ready to sort of take some money off the table and protect from their downside risk.”

Wong-Hammond said the pressure on nonprofit, mission-driven organizations, which made up 46% of survey respondents, has intensified because many run with higher expense loads even in good times.

“Higher expenses have collided very unfavorably with the market stresses presented by the ongoing COVID situation,” she said. “Unfortunately, over the last year, some of the nonprofits elected not to sell and instead focus efforts on COVID containment. There has been mixed success in some of these turnaround stories.”

For others, Cochran added, finding a way out is no longer voluntary. Lease-holders and lenders who negotiated covenants requiring operators to maintain cash on hand or certain census levels may be less willing to negotiate those terms as the pandemic enters its third year.

“Given the current market, it’s hard to meet those kinds of covenant requirements. You may see some CEOs being either pushed by their lenders or as a defensive strategy looking to sell,” said Cochran, a turnaround specialist who often works with facilities in or near default

The National Investment Center for Seniors Housing & Care said in a report Thursday that single-site operators are “significantly less likely to offer rent concessions” than their larger competitors.

Size and staff matter

Cara Silletto, a staffing and retention specialist, told McKnight’s labor pressures are also encouraging providers to focus more on their assisted living and independent living operations, which typically require less clinical and certified staff.

“This projected staffing shortage is the reason many growing providers are focusing solely on lesser-care communities and not focusing on growing through SNF communities,” she told McKnight’s.

Cochran doesn’t expect any major players to abandon the industry, predicting most deals in 2022 will involve organizations with fewer than 50 facilities. He believes activity instead will be dominated by owner-operators growing from five to 10 facilities, or moving from 10 to 20, in the same geographic footprint.

But Wong-Hammond, while not revealing either party’s size, said this week that Lument is moving toward closing “another significant M&A transaction in the sector.”

Rising interest rates clouding the picture

“We have been in discussions with a large number of sellers who are seeing attractive pricing in the market and are asking us if now is a good time to sell,” she said. “While every situation is unique, our advice has generally been ‘yes.’ Now is an attractive seller’s market. This view is formulated predominantly on the fact borrowing rates remain very, very low and there continues to be a large amount of capital on the sidelines.”

Cochran also said he expected an overall increase in M&A this year “as long as the cost of financing stays low.”

Historically low interest rates have helped motivate certain buyers, even as the industry has struggled to regain its operational and financial footing. But nearly 29% of survey respondents from across all job positions told McKnight’s they were worried about inflation. That number was 52% among CEOs.

In addition to making everything — including wages — more expensive, inflation also could lead to interest rate increases, making it more expensive to borrow money.

Inflation is at a 40-year high, hitting 7% over the last year, according to a Consumer Price Index report issued Wednesday. Federal Reserve members have indicated they could react with a series of interest rate increases starting as early as March.