The October 2019 industry shift to the Patient Driven Payment Model allowed all rehabilitation professionals the opportunity to document specific clinical characteristics about the patients we serve and directly tie those areas to reimbursement.

Quite the shift, right?

We were all well trained in providing skilled hands-on care, we all knew how to align care with specific diagnostic categories, how to assess patient needs tied to desired discharge location, and how to include the impacts of complexities and comorbidities in our services.

This is great!

So, we take all these areas and then what? How is the rate determined?

Therapists are, as part of their education and clinical practicums, trained on how to provide, assess and treat patients, and how to advocate for patients’ needs. We also should hold ourselves professionally and personally accountable for understanding reimbursement and how we get paid based on care areas.

Knowledge is key here.

Let’s begin with some basics on PDPM.

We all now understand that following the specific case mix area identification (and documentation and MDS Coding!) for each therapy discipline (i.e. PT, OT, and SLP), there is an additional area tied to a per diem rate for each discipline.

Speech-language pathology is determined using a number of different patient characteristics predictive of increased SLP costs:

• Acute neurologic clinical classification

• Certain SLP-related comorbidities

• Presence of cognitive impairment

• Use of a mechanically-altered diet

• Presence of swallowing disorder

Physical and occupational therapy are determined based on clinical category, and the functional score calculated as the sum of the scores on 10 Section GG items:

• Two bed mobility items

• Three transfer items

• One eating item

• One toileting item

• One oral hygiene item

• Two walking items

What changes in FY 2023, you ask?

Let’s look.

On July 29, 2022, the Centers for Medicare & Medicaid Services issued a final rule that updates Medicare payment policies and rates for skilled nursing facilities under the Skilled Nursing Facility Prospective Payment System (SNF PPS) for fiscal year (FY) 2023.

FY 2023 Updates to the SNF Payment Rates

CMS estimates that the aggregate impact of the payment policies in the final rule will result in an increase of 2.7%, or approximately $904 million, in Medicare Part A payments to SNFs in FY 2023 compared to FY 2022.

This estimate reflects a $1.7 billion increase resulting from the 5.1% update to the payment rates, which is based on a 3.9% SNF market basket increase plus a 1.5 percentage point market basket forecast error adjustment and less a 0.3 percentage point productivity adjustment (as required by law), as well as a negative 2.3% (or $780 million decrease) in the FY 2023 SNF PPS rates as a result of the recalibrated parity adjustment, which is being phased in over two years.

These impact figures do not incorporate the SNF VBP reductions for certain SNFs. These reductions are estimated to be $186 million in FY 2023.

What is a market basket update, and how does this impact reimbursement, you ask?

Every year CMS updates the PPS rate based on changes in the market basket (the overall cost of goods and services that contribute to expenditures required to run and maintain a nursing facility).

This is then adjusted by a forecast error adjustment and multifactor productivity adjustment as applicable. For the FY 2023 market basket updates, CMS has will use second quarter 2022 forecast (with historical data through the first quarter of 2022) of the 2018-based SNF market basket.

For FY 2023, CMS determined an update to the market basket of 3.9%.

This has been adjusted upward to 5.4% due to a 1.5% forecast error adjustment (0.5% threshold).

Finally, the FY 2023 market basket update has been adjusted to 5.1% due to a 0.3% productivity adjustment (the 10-year moving average of changes in annual economy-wide private nonfarm business multi-factor productivity).

Great!

So, following all of these elements… what is the impact on rate?

Let’s simplify all of this down a bit.

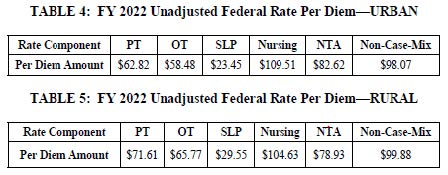

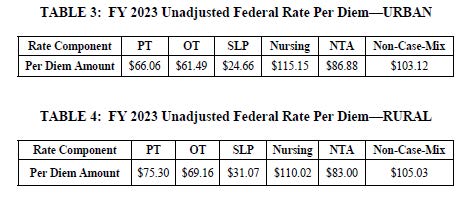

Please reference tables below for an understanding of the FY 2022 urban and rural rates in comparison to the FY 2023 rates.

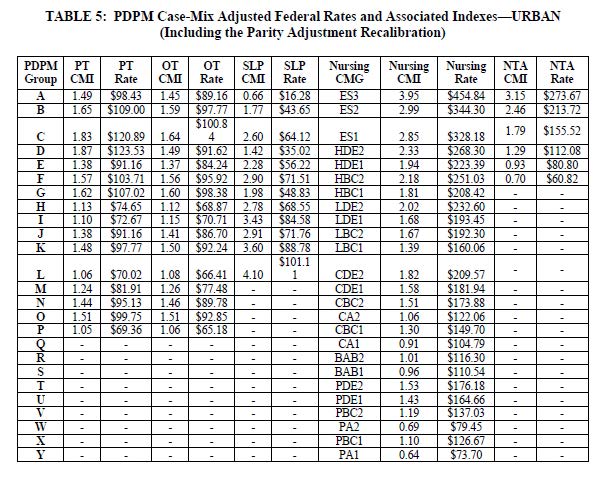

And the rates added to case-mix areas associated with your unique care, your appropriate documentation, and translation of that documentation into MDS coding results in below:

In closing, take time to understand and appreciate the shifts we see yearly in all areas of reimbursement reform.

It is essential that rehab professionals are knowledgeable about these areas for the long-term health of the therapy industry and to allow us to make informed decisions for advocacy areas in the coming years and for generations of therapists to come.

Renee Kinder, MS, CCC-SLP, RAC-CT, is Executive Vice President of Clinical Services for Broad River Rehab and a 2019 APEX Award of Excellence winner in the Writing–Regular Departments & Columns category. Additionally, she serves as Gerontology Professional Development Manager for the American Speech Language Hearing Association’s (ASHA) gerontology special interest group, is a member of the University of Kentucky College of Medicine community faculty and is an advisor to the American Medical Association’s Current Procedural Terminology CPT® Editorial Panel. She can be reached at [email protected].

The opinions expressed in McKnight’s Long-Term Care News guest submissions are the author’s and are not necessarily those of McKnight’s Long-Term Care News or its editors.