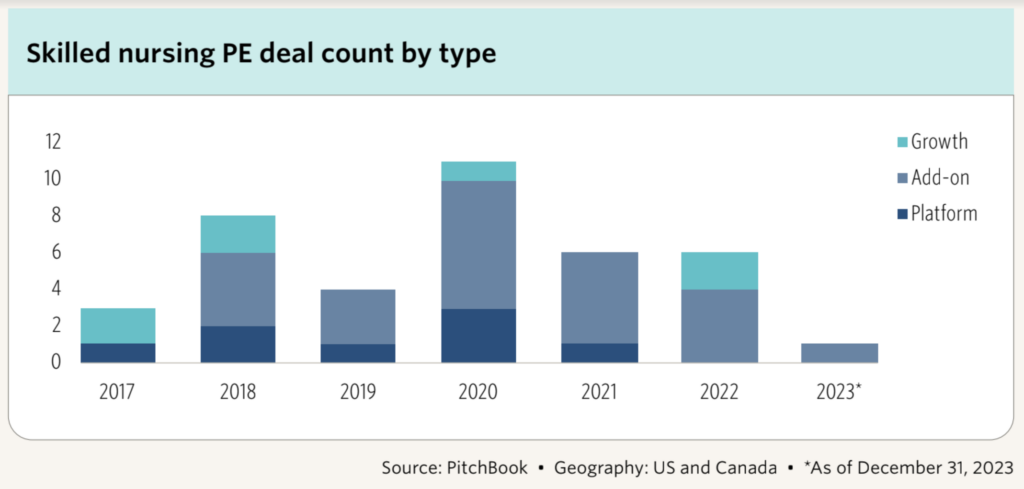

In a year marked by high interest rates and increased federal scrutiny, private equity and real estate investment trusts finalized fewer skilled nursing deals in 2023 than in any year since the COVID-19 pandemic began.

Private equity deals in healthcare overall declined moderately last year — about 16% since 2022 — but skilled nursing was among the sectors with the steepest decline, according to a new report from corporate research firm PitchBook.

The report — compiled by analysts Rebecca Springer, PhD, and Collin Anderson — outlined the industry trend and the economic and policy factors that informed them. A key factor, especially in long-term care, was the increased negative attention from the federal government.

“One of the most important developments of late 2023 was growing antitrust scrutiny specifically targeted at PE healthcare services investing,” the analysts wrote, referencing a December fact sheet released by the White House that decried what it described as the “corporate greed” of private equity involved in healthcare sectors like skilled nursing.

The Federal Trade Commission also increased oversight of corporate mergers that same month, while the Centers for Medicare & Medicaid Services finalized a new transparency rule aimed at private equity and REITs in November.

The report pointed out that all this oversight had less of an impact on the level of actual litigation than on the negative buzz surrounding skilled nursing deals.

“The key effect of the Biden administration’s scrutiny of PE in healthcare is not direct antitrust risk, but headline risk,” the authors wrote. “We have been struck by the sudden change in tone among investors on this topic.”

A November study found that the total share of private equity ownership in long-term care fell from 8% of facilities in 2018 to 5% in 2022.

Interest rates and the future

Regulation certainly had a chilling effect on private equity’s involvement in skilled nursing, but the high interest rates set by the Federal Reserve are a more significant indicator of broader healthcare trends, according study authors. If the rates begin to drop in 2024, it could lead to a new uptick in private equity healthcare deals.

“The key trigger for the resumption of larger platform trades will be material interest-rate cutting by the Federal Reserve,” the analysts explained, “which the market currently expects to happen in the second half of 2024. Deal activity will reaccelerate gradually as sponsors attempt to avoid overlapping deal processes and feel out market pricing.”

Sectors like long-term care may remain risky for investors in 2024 even with lower interest rates, however, according to the report.

“While the interest-rate environment remains the most important driver of the pace of dealmaking, we also believe sponsors will be somewhat more cautious in 2024 about entering any provider categories that primarily serve vulnerable populations,” the analysts wrote.

Despite these factors contributing to slowed growth and a contentious presence in the skilled nursing sector since 2020, some REITs seem poised to expand in 2024. The PitchBook report also notes that antitrust pressure from the federal government would likely be “eliminated” by the election of a Republican president in 2024.