A declining pool of lenders may have undercut some deals during what was otherwise a fast-paced quarter for mergers and acquisitions in long-term care and seniors housing.

Ziegler on Wednesday released an update to a Q1 survey it conducted with the National Investment Center for Seniors Housing & Care, designed to take a pulse of lenders that have historically played an important role in the industry.

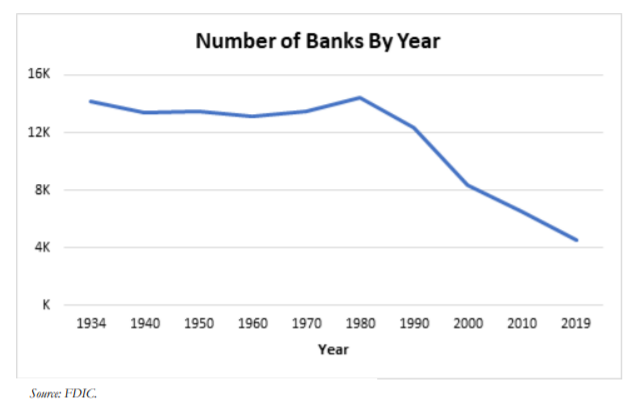

The update honed in on what Ziegler called a concerning but “unnoticed” trend: the consolidation of banks and other lending institutions that many senior care organizations turn to for loans. In the last 20 years, the investment banking firm estimates about half of all banks have been acquired or gone out of business.

“While there is no single data source that tracks all lenders or senior housing and care loans, the majority of loans of any size originate from approximately 115 different banks and lending institutions across the country,” report authors stated. “Our research indicates that from 2019 to present, 25 entities have dwarfed into 12. … That reduction in the number of banks generally means a reduction in the total available bank lending universe and dollars available to the industry, at least in the short term.”

Don Husi, Ziegler’s managing director, said the firm has concerns that the number of bank combinations, particularly over the past few years and with the brunt of the pandemic, are squeezing the supply of potential dollars available to the industry.

“The impact when banks combine is an additional factor,” Husi told McKnight’s Long-Term Care News on Wednesday. “With the supply of banks shrinking and the need for capital expanding, this will likely lead to the supply side being able to dictate terms. The number of bank combinations over the past two years is a bit surprising, and we expect we likely will see more (consolidation).”

In addition, the survey report noted the four of the top 10 largest banks _ Chase, U.S. Bank, Santander and Citibank — don’t have a formal division to underwrite senior housing and care. Instead, they often leave credit decisions to local and regional decision makers and to teams better versed in commercial, industrial or not-for-profit specialties.

Ziegler illustrated how the shortage of lenders trickles down to impact operators.

The firm this spring requested a non-recourse or limited recourse, 80% loan-to-value percentage loan collateralized by two properties with a strong corporate credit profile and better-than-average occupancies emerging from COVID-19.

Although Ziegler received “three very aggressive offers,” banks declined to issue loans due to the recourse requests or because they viewed the properties as “troubled assets.”

“It will be interesting to monitor this trend and its impact on lending metrics going forward,” Ziegler said.

Only 16 of 115 solicited banks or other lenders responded to the survey, which has been conducted quarterly since July 2020.

Of those, 56% reported lending to both the private and tax-exempt sectors, but more than one-third said they had only lent to private sector owners and operators.

Most respondents also reported having a 71% to 55% maximum loan-to-value requirement across the majority of property types, with those lending to organizations with a majority of independent living assets trending lower at 60% to 65%.

Other key findings of the survey, which had the latest data compiled between April 22 and May 10, 2021, include:

Stabilized senior bridge lending and new construction continue to be the leading types of loans.

Deal size appears to be increasing over prior quarters with more lenders indicating loan sizes in the $16 million to $40 million range, which could be a sign that the market is bouncing back.