Sabra Health Care REIT is actively reducing its dependency on skilled nursing facilities by broadening its asset holdings to include more senior housing and behavioral health facilities.

Executives for the California-based real estate investment trust detailed their strategy for the year during a first-quarter earnings call Thursday. The company plans to diversify its portfolio in 2022 in an effort to reduce its SNF exposure, Sabra CEO Rick Matros explained.

“It’s pretty simple. When we’re viewed as a more diversified REIT, we trade at a better multiple. It isn’t as if we’re going to have no nursing homes. If we get down to 50%, that’s still half the portfolio,” he said. “We want to be more diversified.”

He also cited the “19 seconds during the State of the Union” for their shift in strategy. That’s in reference to President Biden’s historic mention of nursing homes, criticism that will sting for a long time.

“No matter how well we think things may be going for us in terms of future opportunities, this industry has bad headlines — most of the time undeserved,” he added.

“You see all of the COVID-related stuff? The hospitals don’t get that but the nursing homes do and it’s really a shame. We just don’t want to be overly dependent on one asset class or be viewed as being a single asset-class REIT,” Matros said.

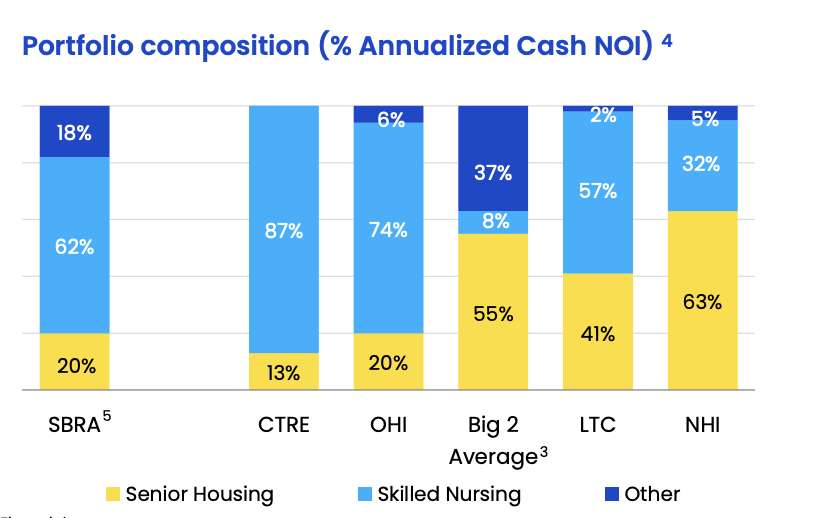

SNFs and transitional care facilities made up 61.7% of Sabra’s asset class concentration as of March 31. Behavioral health represented 13.4%; senior housing – leased represented 12.2%; senior housing – managed, 8.2%; specialty hospital and other facilities, 4.5%. Based on annualized cash net operating income, Sabra’s portfolio is 62% SNFs, 20% senior housing and 18% other facilities.

Sabra’s behavioral health portfolio has also grown considerably in recent years with a total investment of about $730 million, currently yielding 8.3%, which accounts for roughly 13% of the Company’s annualized cash NOI.

The company’s low point on SNF exposure came just prior to its Care Capital Properties merger announcement in 2017 when it was at 57%.

“We think we have an opportunity to be there or better by the end of the year,” Matros said. “It’s a combination of a number of things.”

Matros said the shift in strategy stems from there being more opportunities for growth in seniors housing and behavioral health, and the private market being able to pay more for SNFs than REITs right now.

“The other is asset sales, so we are going to be doing more asset sales than we had anticipated just because of the strength of the private market,” he explained.

He added the company couldn’t provide a solid number on what its expectations are but did say last year Sabra did $100 million in asset sales and expects it to be “quite a bit more than that this year.”

“Not more than $300 [million] but more than $100 [million],” he added.

See additional coverage of the earnings call in McKnight’s Senior Living.