PACS Group this week filed to become a publicly traded company, a move the giant long-term care company is promising will allow it to add to its explosive growth in coming years.

Utah-based PACS serves more than 20,000 patients daily, and the company had a total revenue of $3.1 billion in 2023, according to its Wednesday filings with the US Securities and Exchange Commission.

In its Form S-1 Registration Statement, PACS highlighted its core operational approaches, including a strong local leadership model built around its Administrator-in-Training program and an emphasis on quality.

More than 200 pages of documents and charts reveal what is in many ways outsiders’ first full picture of how the relative newcomer came to dominate skilled care in several key states. It also projects why company leaders think they will be successful in a public offering that some estimate could be valued at $500 million.

“We believe our success is driven in significant part by our decentralized, local operating model, through which we empower local leaders at each facility to operate their facility autonomously and deliver excellence in clinical quality and a superior experience for our patients,” company leaders wrote in the SEC documents.

“We provide our independently operated facilities with a comprehensive suite of technology, support, and back-office services that allow local leadership teams to focus more of their time and effort on providing quality care to patients,” they continued. “We believe our operating model delivers value to all of our healthcare stakeholders, including patients and families, referring providers, payors, and administrators and clinicians.”

The question now is whether investors will see the potential value for themselves.

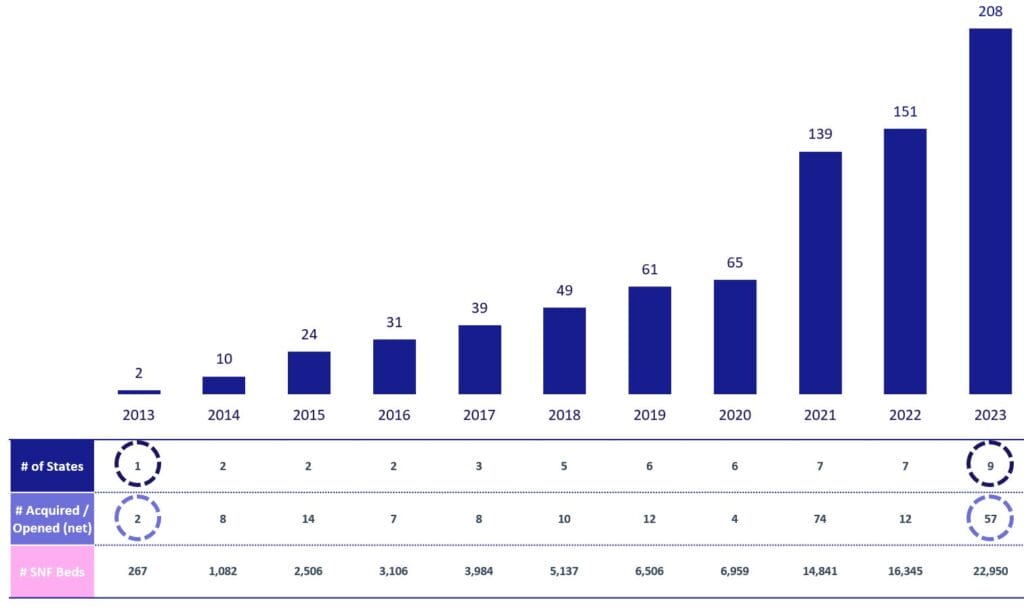

The prospectus drills deep into the near-explosive growth at the company, which was co-founded and continues to be led by CEO Jason Murray. As a private company, PACS hasn’t previously been required to report purchases, though some transactions have been detailed by operating partners and state government officials.

PACS doubled in size in 2021, when it acquired 58 operations formerly held by Plum Healthcare. Among its more recent transactions was the late 2023 takeover of seven former ProMedica facilities in California, which added to the group’s extensive California footprint that already included more than 10,000 beds.

PACS was founded in 2013, and now manages more than 200 post-acute facilities, most of them nursing homes, in nine states. It is believed to be one of the nation’s top three skilled nursing providers by bed size.

Growth as strategy

Continued growth is a core tenet of the value PACS appears to be offering would-be investors.

The company described its strategy as multi-faceted and noted that it intended to grow both organically (which senior care excess often mean to come through census) and through “inorganic levers,” such as further acquisitions in existing and new markets.

“We have historically completed an average of approximately 20 acquisitions and one de-novo, or new-build, facility per year, but have the flexibility to increase or decrease this cadence from period to period in line with our business priorities and as strategic opportunities arise,” leaders wrote. “We plan to continue to strategically pursue opportunities within our pipeline to supplement our organic growth.”

The company currently has 66 new facilities and 77 “ramping” facilities, or those purchased within the last 18-36 months, and said those could forecast expectations as they come more fully onboard.

While the company acknowledged it leases most of its buildings, some from real estate investment trusts, including CareTrust, it also said taking a greater ownership stake is a future goal.

Quality attracts

Throughout its filings, PACS consistently noted its ability to attract referral partners and patients at a time when demand for skilled nursing services is just ramping up along with the aging baby boomer population.

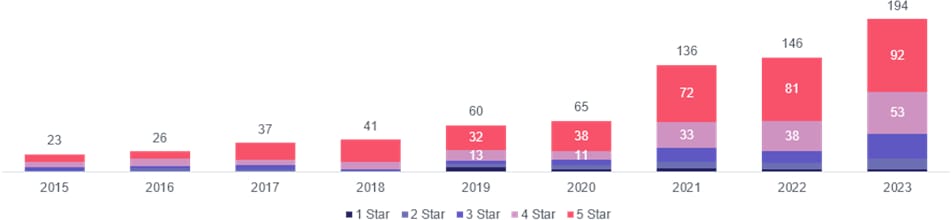

“Excellence in clinical quality and experience for our patients is at the forefront of our mission,” leaders wrote, bolstering that statement with claims that the company average a 4.1 Five-Star rating across all of its facilities as of Dec. 31, compared to a 3.6-star average for all nursing homes nationally.

The company also outlined how it has already invested on behalf of quality improvements, including in capital improvements and maintenance, even in facilities it leases.

“Our renovations are intended to improve the look and feel of facilities in order to provide an excellent experience,” they said. “Our investments into medical beds, vitals monitors, physical therapy equipment, and other improvements allows us to provide services to higher acuity patients. We believe our high-quality facilities lead to sustained referral volumes, more admissions, and high skilled mix at our facilities, ultimately leading to higher occupancy rates and revenue per patient day. We also believe our investment into leased facilities makes us a preferred tenant with our landlords and provides us leverage in negotiating favorable lease terms.”

With significant market density in its current states, PACS said its brand recognition has helped it attract repeated referrals from key hospitals and health systems. Its groupings of nursing homes ensure they can meet the demand “without turning patients away to competitors.”

“We also believe our size and scale has provided us with the ability to negotiate favorable contracts with managed care and other payor sources, the ability to navigate stringent regulatory compliance obligations and withstand potential reimbursement and regulatory industry dynamics, and the ability to leverage real estate value for liquidity and growth,” PACS said.