Nearly 60% of skilled nursing managers expect they’ll have to continue restricting admissions in 2022, as census challenges fueled by staffing shortages and COVID-19 surges continue to threaten facilities’ viability.

In addition, about 45% of respondents in the McKnight’s 2022 Outlook Survey said they expected their skilled nursing occupancy to increase this year, but more than 12% said they thought it would decrease.

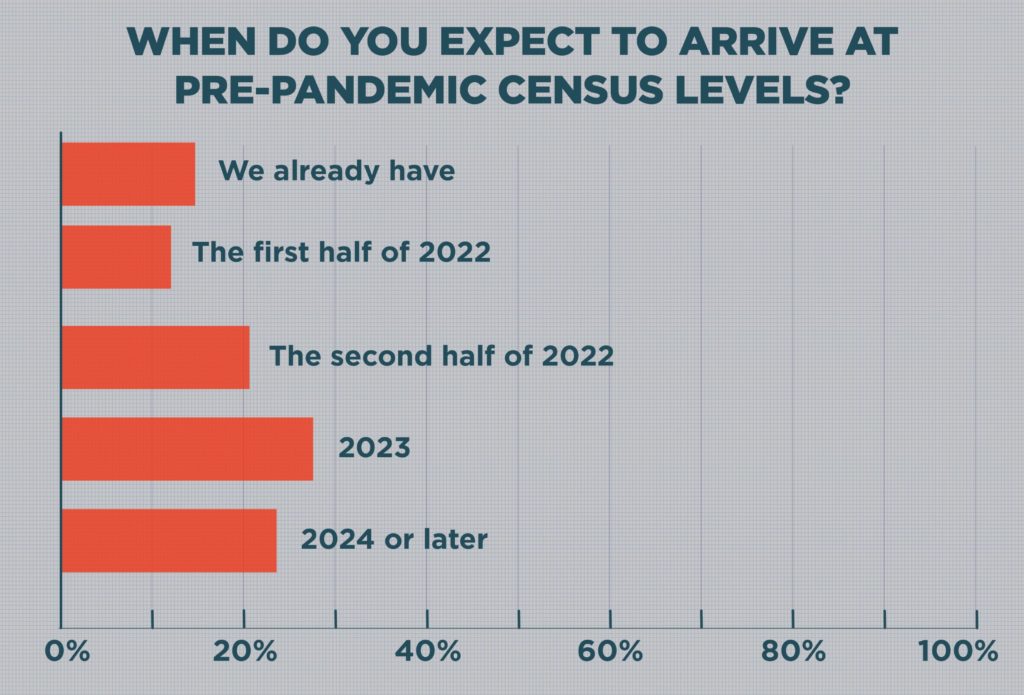

Notably, 50.2% said skilled census likely wouldn’t match pre-pandemic levels until 2023 (28.4%) or 2024 or later (21.8%).

Those views were captured by McKnight’s Long-Term Care News in a survey of 317 nursing home owners, administrators and top nurse managers. They responded to email questionnaires between Dec. 10 and Dec. 30.

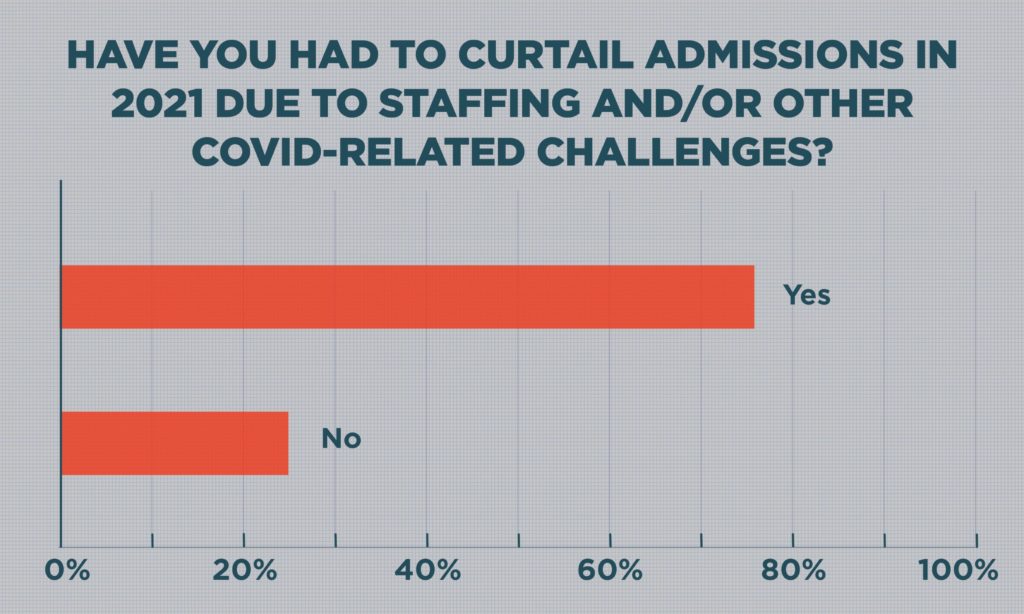

Nearly three-fourths of respondents (74.8%) said they had had to restrict admissions in 2021, a rate 28% higher than an industry-wide survey conducted by the American Health Care Association / National Center for Assisted Living in September. At that time, AHCA reported that 58% of providers were limiting admission, but staffing pressures have since escalated. COVID-19 waves fueled by the delta and omicron variants also forced hospitals to again start limiting elective surgeries and reduce referrals.

Those factors, along with concerns about reimbursement, compliance changes, and rising costs, left respondents feeling largely pessimistic about the year ahead.

Nearly 57% said they were less optimistic about the industry’s prospects in 2022, with another 24.2% taking a neutral stance. Only 18.8% said they felt more optimistic.

“Our economic recovery has been slow, and many providers are having to limit the number of residents they serve due to staffing and financial challenges,” AHCA told McKnight’s in a statement Monday. “Not only is a historic labor crisis impacting our ability to recover, but we’re also dealing with price gouging by temporary staffing agencies and inflation increasing other operating costs. Now, another surge due to Omicron threatens our already exhausted frontline caregivers and battered profession. It is no wonder that more than half of providers are less than optimistic about the coming year. “

Early in 2021, AHCA leaders had estimated a 1% occupancy gain each month would put the industry back on solid footing. But after a period of modest gains last spring and summer, many skilled nursing providers began to once again experience declines, according to a September release from the National Investment Center for Seniors Housing & Care.

In a separate NIC MAP Data Service skilled nursing report released Dec. 30, occupancy had rebounded through October to 75.4%. That’s above the pandemic-low of 71.6% but still far from the pre-pandemic occupancy rate of 85.8% in February 2020.

As time passes, pressure builds.

“Sustainable occupancy levels can vary by operator,” NIC Principal Bill Kauffman told McKnight’s Monday. “However, in general, occupancy is still at low levels, and many operators will be unable to sustain operations if their cash flow is below break-even levels for an extended period of time.

Amid the current climate, limited referrals from COVID-strapped hospitals may continue to be a secondary issue, behind coast-to-coast hiring and retention challenges.

“There is much discussion from many operators that the occupancy challenges are not a demand issue, but a staffing/labor issue,” Kauffman added. “Many operators are unable to find or retain the staff to accept new admissions.”

Signs of hope

Amid the negative implications in the 2022 Outlook Survey responses, there were some reminders of positive change: Fifteen percent said their buildings had already returned to pre-pandemic census levels, with about 12.4% expecting to do so in the first half of this year. Another 20.5% expect to get there in the second half of 2022.

Returning to full operations also has been a relative bright spot for many respondents. In late December, 26% said they had already resumed all normal activities, including group dining, visitation and day trips. Another 37.6% anticipated they will reinstitute all of those activities — crucial for combating isolation and attracting prospective residents — sometime in 2022.

And many providers — nearly two-thirds — said they stand ready to add new or expanded services in 2022.

Specialties such as dialysis, ventilator units, pain management and certified clinical programs were the types of service lines most likely to be added, at 34.7%. Specialties — particularly those connecting skilled nursing with hospitals or additional clinical staff — grew in popularity during the pandemic, when hospitals continued to become less likely to refer traditional orthopedic patients for in-patient rehab.

The addition of ancillary services, such as in-house pharmacy, therapy and home health practices, came in second at 21.77%.

Adding services is one way for nursing homes to increase their staying power, notes Ryan Cochran, a partner at Waller, a nationwide law firm based in Nashville. He leads the firm’s finance and restructuring practice, representing receivers and trustees in skilling nursing and other senior living transactions.

“You’re increasing your revenue streams,” Cochran told McKnight’s. “That also makes you more attractive to a hospital who’s looking to make referrals to a facility that demonstrates it’s got higher acuity and the ability to reduce readmissions back to the hospital.”

In some cases, those programs also can help facilities pick up staff, such as trainers affiliated with upstream providers or specialists who round regularly.