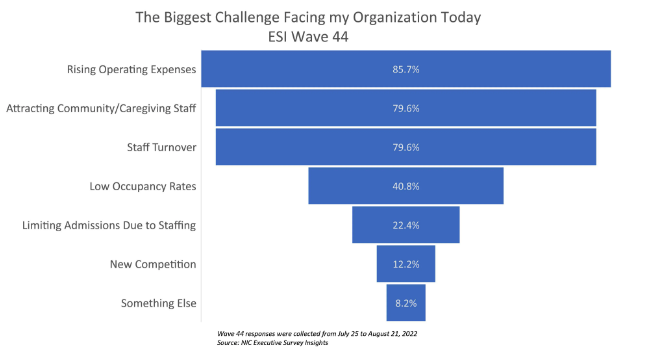

Eighty-six percent of respondents said rising operating expenses were the most pressing worry facing their organization. That’s up from three months earlier, in NIC’s Wave 41 survey, when 80% of responding organizations said rising operating expenses were their biggest concern.

NIC conducted its Wave 44 survey from July 25 to August 21. Owners and executives of 55 small, medium, and large skilled nursing and senior housing operators took part.

Health Dimensions Group CEO Erin Shvetzoff Hennessey said Thursday that skilled nursing operators are especially hurt by inflationary pressures. Particularly with staples such as food, supplies and energy.

“In a low-margin business, even small increases make an impact and, given these things are operational necessities, it is not an easy area to impact in expense control,” Hennessey explained.

“While seniors housing has flexibility in rate changes, with many having made significant increases several times in the last year, skilled nursing waits a long time for rate increases,” she told McKnight’s Long-Term Care News. “By the time skilled nursing operators see increases, the expenses have been incurred, in prior years.”

Staffing still rough, but improving?

Despite losing the ignominious biggest worry berth, staffing obstacles remain formidable, NIC respondents indicated. Since July 2021, between 96% and 100% of operators responding to NIC’s Executive Survey Insights have reported staff shortages. In Thursday’s release, attracting community and caregiving staff and turnover tied for the second-highest concern (80%).

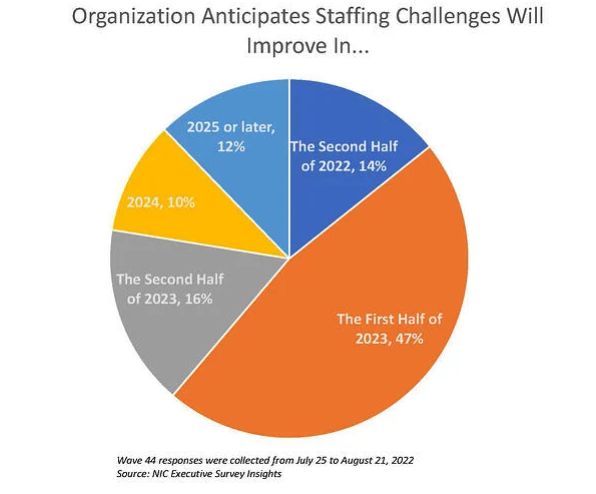

However, nearly three-quarters of Wave 44 respondents said they were optimistic that staffing improvements are looming. Some 37% anticipate their reliance on agency or temporary staff will decrease.

About 1 in 7 (14%) predicted staffing challenges to improve in the second half of 2022, while the most popular forecasts were for improvements in the first half of 2023 (47%), and the second half of 2023 (16%).

Inflation’s biggest LTC victims

Earlier this summer, the 2022 McKnight’s Mood of the Market Survey found that nursing and other labor costs topped the list of expenses hardest hit by inflation over the last year. Food/dining services, PPE and infection control followed.

Registered nurses reported a wage jump of 11.1%, according to the 45th annual HCS Nursing Home Salary & Benefits Report issued in late July.

Thirty-six percent of Mood of the Market respondents said inflation had hit construction costs the most. The number was over 40% among administrator respondents. Just under 50% of respondents said they’d delayed a building or capital improvement project, and that number was more than 53% among administrators.

Lisa McCracken, director of senior living research with Ziegler, told McKnight’s Long Term Care News that the rise of inflationary concern is not surprising, considering the increases come from not only wages but supply costs.

“Many operators are wrestling with how to effectively cover the rising costs,” she said. “You can aim for expense reduction, but you can only go so far before you start to compromise the quality of housing and services. You can pass along to the residents, but you can only go so far with that as well.

“The remedy is a multi-pronged approach. It is a bit of a moving target in recent months, so operators need to be vigilant with expense management and nimble in their strategies to respond.”

As for cost-cutting measures addressed in the Mood of the Market, nurse leaders cited restricted admissions at about the same rate as administrators. Twenty-nine percent in each job category said they had discontinued services such as recreation activities, trips or entertainment.