Beleaguered post-acute care giant Genesis HealthCare announced this morning that 17-year CEO George V. Hager Jr. is retiring from his posts as CEO and company director.

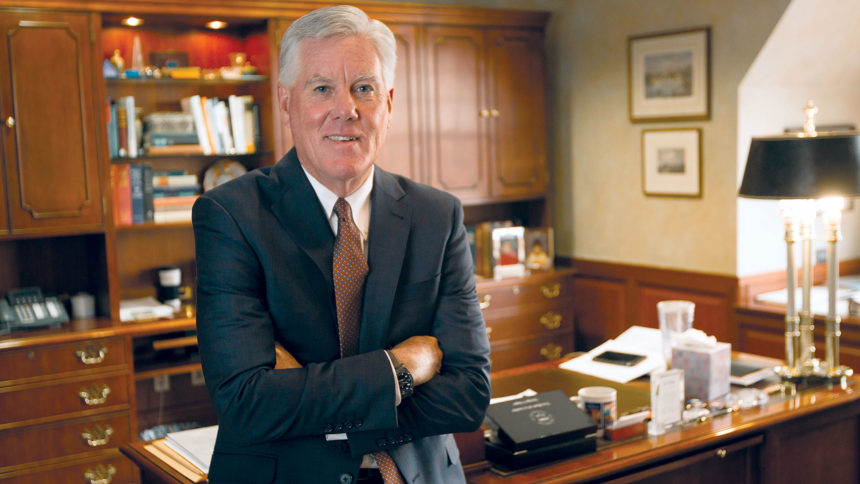

Board Chairman Robert H. Fish, who has long ties to the company, will replace Hager, who will stay on for a period as a senior adviser. Fish will also remain as board chair.

Genesis HealthCare includes more than 325 skilled nursing facilities and assisted living/senior living communities in 24 states. Its subsidiaries also deliver rehab therapy services to about 1,100 providers in 44 states and China.

The company has suffered badly financially in recent years, more than once being “delisted” as a publicly traded stock falling below $1 per share in value. Last year, Hager stated during second- and third-quarter earnings calls that it was doubtful that Genesis could continue to operate as a going concern, buffeted by effects of the pandemic but also other financial pressures present before the national public health emergency emerged.

Most recently, in November, Hager said that there was no question the company would require more financial support from creditors and government resources “to sustain operations.”

Fish has been a member of the Genesis Board of Directors since 2013 and has been its chairman since 2017.

He has a long history with Genesis and its predecessor companies Genesis HealthCare Corp. and Genesis Health Ventures, Inc. He joined Skilled Healthcare Group, Inc. as CEO until its merger with Genesis in 2015. Additionally, from 2003 to 2007, he served as Lead Director of Genesis HealthCare Corp., and from 2002 to 2003 he served as Chairman and Chief Executive Officer of Genesis Health Ventures, Inc.

Fish also has served as chairman, president or CEO of several other healthcare companies. Most recently, from 2018 to July 2020, he served as President, CEO and Director of Quorum Health Corporation, a publicly held operator of general acute-care hospitals and outpatient services.

“The board and I would like to thank George for 28 years of unwavering leadership and tireless commitment and service to the company, its employees, patients, residents and families, and to the entire post-acute industry,” Fish said in a statement. He added that Hager would assist with transition and “restructuring” efforts, while also continuing advocacy efforts “for the company and the industry.”

Hager called the company “fortunate” to have Fish step in “as a leader with significant experience both inside and outside of Genesis.”

In June, McKnight’s recognized Hager as one of the most prominent long-term care newsmakers of the last 40 years in its celebrated McKnight’s 40 for 40 series.

Considered a financial guru who steered Genesis toward more investment in physician services and clinical operations, he also oversaw a pair of huge acquisitions that many saw as overly ambitious.

In 2014, the company doubled in size by acquiring Sun Health, an overwhelming move that exposed how ill-matched the companies were for integration. A few months later, it acquired Skilled Healthcare, an even less-successful move but one that fast-tracked a way for Genesis to re-emerge as a public company, offering everything from assisted living, a robust rehab company and much more.

This is a developing story. Please check back for updates.