An effort to improve transparency into nursing home ownership took a major leap forward when federal officials posted previously non-public data Wednesday. But providers and legal experts cautioned that early findings should not be viewed in a vacuum.

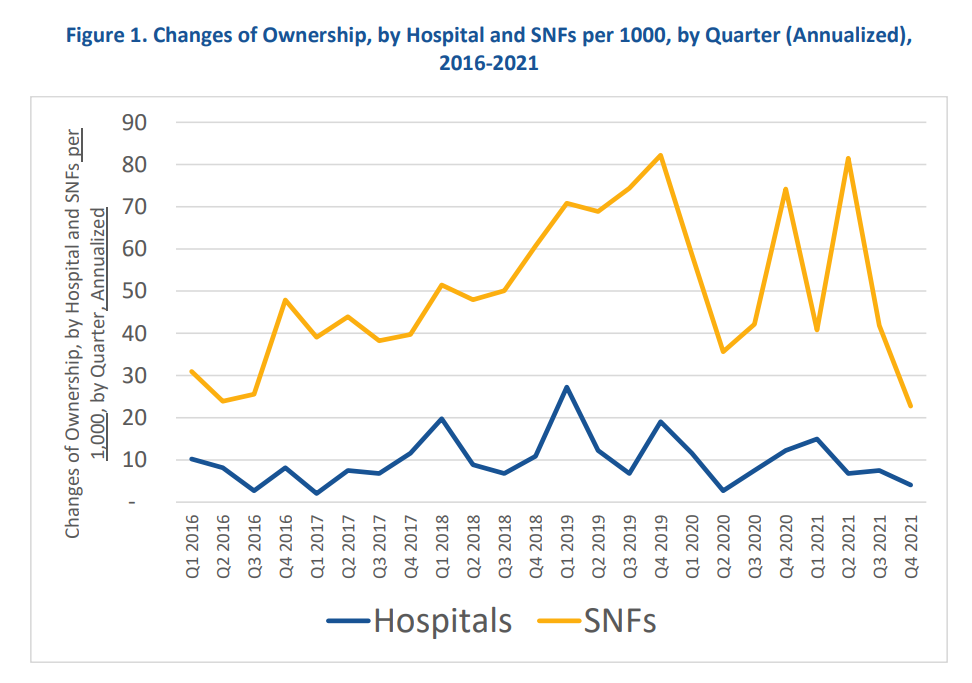

A Department of Health and Human Services analysis of nearly 4,000 transactions over a six-year period revealed 3,236 nursing homes were sold in that time, compared to 348 hospitals. That equates to 39.9 sales annually per 1,000 SNFs versus 9.8 per 1,000 hospitals, HHS said.

The American Health Care Association/National Center for Assisted Living told McKnight’s Long-Term Care News Wednesday afternoon that it “supports financial transparency of nursing homes and appreciates the efforts by the administration to share this information with the public moving forward.”

But the association cautioned that policymakers likely need more context to understand what factors shape nursing home ownership trends.

“We must also consider how the chronic underfunding of long-term care interplays with the financial decisions nursing home providers may feel pressured to make,” AHCA said in a statement. “The industry remains steadfast on improving care by focusing on the metrics that will make a meaningful difference in the lives of our residents. Policymakers and providers should work in tandem on these efforts, so that no matter who owns a nursing home, residents receive the highest quality care.”

The Centers for Medicare & Medicaid Services’ decision to post the data marked the first time the agency has compiled and publicly shared in one easy-to-access file information on mergers, acquisitions, consolidations and changes in ownership. The update supports a broader White House initiative aimed at providing ownership insights that the administration believes will trigger quality improvements.

A LeadingAge spokeswoman Wednesday declined to comment on the CMS move, saying the organization was still reviewing the database. The National Investment Center for Seniors Housing & Care did not return a request for comment by deadline.

Poor causal connection?

But several lawyers who represent skilled nursing clients questioned the initial CMS approach to sharing nursing home ownership information.

“Most owners of SNFs and hospitals are silent investors, meaning they do not have any say or control over the day-to-day operations of the medical entity,” said attorney Christine L. Stanley, a partner at Quintairos, Prieto, Wood & Boyer.

“With regards to actual patient care and CMS’ concern with short-term mortality, this data does not look into or explain the resident/patient comorbidities, age, general health, number of hospital visits (or) family support — all factors that are way more determinative of mortality than ownership.”

Creating a causal connection between ownership and care does the public more of a disservice, leading them to focus on ownership rather than the individual ailments that plague their loved one and the actual care that was received in these facilities,” Stanley added. “The focus on ownership diverts the attention away from what really matters.”

Putting the data to work

CMS simultaneously posted similar information for the nation’s hospitals. Both data sets range from 2016 to 2021 and include information regarding Medicare-funded facilities that had changed hands or otherwise seen changes in financial control.

The data is derived from the Provider Enrollment, Chain, and Ownership System (PECOS), through which Medicare-paid providers must self-report any changes in nursing home ownership within 30 days. CMS said it would update the publicly posted information quarterly.

Each data element includes the names of individual owners or organizational owners, as well as legal business names, the names facilities do business as, addresses , ownership or managing control role, percentage of ownership interest, and ID numbers that can be used to crosscheck if the same owner is associated with multiple entities.

But CMS officials still need to see how the data fits against other metrics to shape potential policies meant to draw a link between nursing home ownership status and care quality. In both a CMS statement about the release and the HHS analysis accompanying the data drop, officials encouraged its use by researchers, “enforcers” and the public to help analyze trends and issues.

“Future research could use these data to explore a range of issues such as impacts of ownership changes on healthcare costs and quality,” HHS analysts in the Office of Health Policy in the Office of the Assistant Secretary for Planning and Evaluation wrote. “Research could explore the extent to which infection control, staffing, quality metrics, patient safety, patient satisfaction, and patient experience are associated with the likelihood of a change in ownership and the impact of such changes.”

Legal implications

The speed of the data publication was “noteworthy,” said attorney Howard L. Sollins, a shareholder at Baker, Donelson, Bearman, Caldwell & Berkowitz, on Wednesday. But he added that it was consistent with forward movement by CMS on other parts of the Biden administration’s reform plan.

“What is surprising is that, rather than asking for comment and input, the agency decided to move forward making data available,” Sollins said.

He previously told McKnight’s that the federal government needs a better understanding of private investment in nursing homes overall and the role it plays in capital and quality improvements.

The analysis tied to Wednesday’s rollout suggests areas of interest to the government and for potential research, Sollins also noted.

“Publicly-available data on ownership changes will enable researchers and policymakers to have a more detailed understanding of ownership of healthcare facilities and concentration of healthcare markets,” analysts wrote. “These data can also allow regulators to better track consolidation in healthcare provider markets and, in the long run, support pro-competitive policies that can help reduce healthcare costs.”

HHS pointed to a 2021 Executive Order that directed the Justice Department and Federal Trade Commission to review and revise merger guidelines, adding that timely data on nursing home ownership may aid in that process as well as Congressional efforts to monitor private equity investment.

But Sollins cautioned that it is important to consider whether the PECOS self-reporting process is “clear and efficient” before drawing too many conclusions. HHS itself reported that the current data drop would not be the only tool the department uses to better understand which ownership types operate facilities.

Still, there are other potential implications of Wednesday’s posting. Attorney Drew Graham said his firm has had to rely on limited nursing home ownership data culled from Nursing Home Compare in the past.

“On the civil litigation side, transparency like this should provide efficient access to information that prior to this, at least in state court litigation, was available but subject to the discovery process,” said Graham, partner and founder of the long-term care practice group at Hall Booth Smith in New York. “I don’t expect that it will be used against providers per se, but it will likely increase the number of defendants named in civil cases as attorneys representing plaintiffs expand the litigation to include a larger number of entities or individuals.”

And that could lead to another problem for a sector very much in need of financial support, Stanley added.

“The more CMS does to override healthcare business models, the less people will want to invest,” she said in an email. “ I don’t know that this move does it on its own, but the more that they tack on, the less worthwhile it will be.”