The Centers for Medicare & Medicaid Services is proposing to radically change how they pay skilled nursing facilities to care for Medicare patients after hospital stays. Today, under the RUG IV rule and formula, the economic engine of the facility is the rehab department and the fuel for that engine is the volume of minutes of therapy provided by physical, occupational, and speech therapists.

The more minutes of therapy, the higher the payment. Are there unintended consequences from the current model? Of course. I think we’ve all sadly seen examples of cringeworthy decisions and care plans made to capitalize on the current model. With the possible replacement of RUG IV with RCS-1, CMS is not looking to fix the engine. They’re removing it.

As I’ve talked with administrators, nurses, and therapists about RCS 1 over the past couple weeks, the reaction has been consistent:

- Blank Stares followed by

- Disbelief followed by

- Minds Racing to predict the consequences.

Why?

The RCS1 formula to determine a daily PPS rate is, at a high level, this is to determine why the patient is admitted to the SNF.

- Why is the patient here?

10 categories: Major Joint or Spinal, Non-Orthopedic, Acute Neurologic, Non-surgical orthopedic/Musculoskeletal, Orthopedic Surgery (Except Major Joint), Cancer, Acute Infections, Pulmonary, Cardiovascular & Coagulation, Medical Management - What is the functional status of the patient?

Higher functioning, less dependent = higher score/payment - What is the cognitive function of the patient?

Higher cognition = higher score/payment - Is the patient depressed?

Depressed patients = higher score/payment - What non-therapy ancillary things are going on with the patient?

IV med, Feeding tubes, Dialysis, etc. = higher score/payment

Could RCS-1 mean an unintended windfall for operators? Maybe.

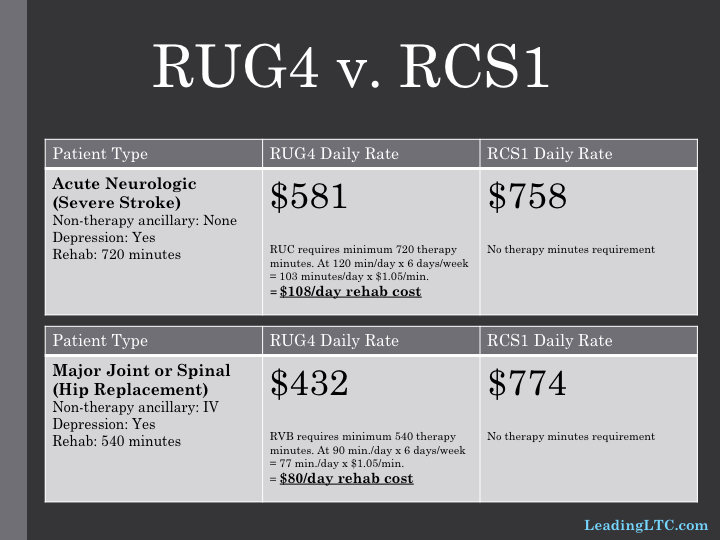

Let’s compare the RUGIV and RCS1 payment for a couple common Medicare SNF patient types. Let’s choose Kansas City as our market.

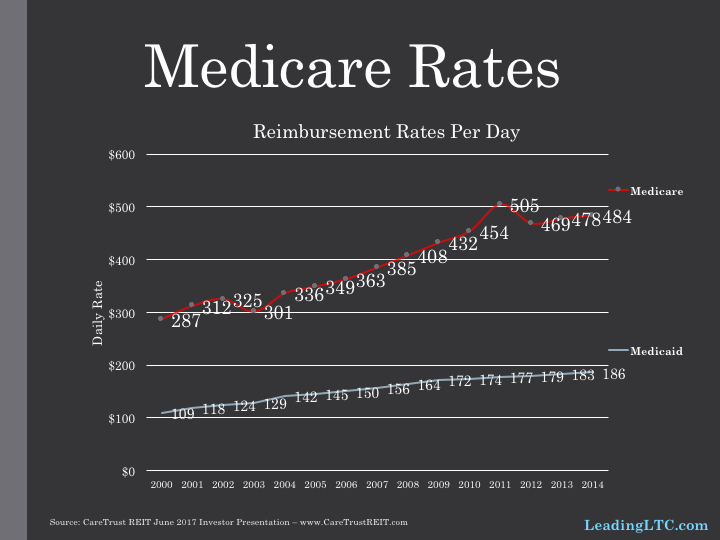

CMS is notorious for underestimating operators’ ability to pivot to the changing goal posts. Can you imagine a replay of 2011/2012 when the change to RUG4 resulted in a windfall for savvy operators followed by an immediate cut by CMS to fix it (see Medicare rate chart)? I can.

Keeping the minutes static, the daily profit increases by $177 and $342 for the stroke and joint replacement patients respectively. But the RCS-1 formula begs the question: why would you keep the minutes static? The minutes/RUG thresholds are artificial constructs by CMS. When those thresholds disappear, what does care planning by the PT/OT/ST look like? Will they give more or less? What will the directives be from management? Can you see the pendulum swinging too far for some organizations that try to cut therapy to the bone since it will become a cost center (financially speaking)? I can.

Plus: How will rehab companies and/or rehab departments change how they care plan? More group/concurrent therapy? More use of aides in the states that allow it? More use of RNAs? More intense rehab during the first half of the stay?

Here’s the thing, love them or hate them, the minutes thresholds provides everyone (management and clinicians) with a framework that encourages therapy to be given but also provides a “governor” on how much therapy is given. What’s the governor or regulator under RCS-1? Patient outcomes. Is that it? Looks that way to me.

Any operator who wants to maintain or grow their Medicare market share must earn it today. Bagels are being replaced by data — length of stay, readmission rates by diagnosis, episodic cost of care, star ratings — to determine short-term patient market share.

RCS-1 doesn’t change that reality. How can you possibly attract short-term patients and deliver optimal outcomes on those data points without exceptional (sufficient & effective) PT/OT/ST? I don’t see it. Nevertheless, I would anticipate rehab companies and rehab departments to drive more efficiency — cutting out the gray-area treatments that milk the minutes but are not the most effective/efficient methods. How are outsourced rehab companies preparing for this? Are they going to continue to charge the same way or will they develop new metrics?

I think we’ll develop new rules of thumb for rehab hours and dollars per patient day (PPD) like we have for nursing today. Nursing minutes are not part of the reimbursement formula today, like rehab minutes are not part of the formula under RCS1. Today, we see some Medicaid-dominant facilities staffing nursing at 2.8 hours ppd. High-acuity, short-term facilities may staff around 4.5 hours ppd. What’s the regulator for staffing the cost-center known as Nursing? Patient need/outcomes. I believe we’ll see rehab staffing in facilities in a similar way.

My focus so far has been at the operator/facility level. But how will underwriting and valuations of facilities change in 2018 and 2019? I think it’s safe to say, our current underwriting models will need major updating if RCS-1 goes through as proposed.