Optimism for the skilled nursing sector is growing, with intense worries about staff shortages and less-than-desired occupancy starting to recede. But concerns about escalating financial pressures have swiftly moved into the void, according to findings from the McKnight’s 2023 Outlook Survey.

Thirty-one percent of all respondents said they were more optimistic about prospects for the industry in the coming year, up from just under 20% in the 2022 survey. The share that reported feeling less optimistic dropped from 57.7% in 2022 to 39.2% in 2023. The decreased pessimism tracked across categories, from nursing supervisors to owners.

“Optimism is on the uptick, but it’s a guarded optimism, I think,” said Bob Lane, president and CEO of the American College of Health Care Administrators. “With this administration, you never know what they’re going to pull out of their pocket next and throw at us.”

McKnight’s Long-Term Care News garnered just under 1,000 responses from nursing home owners, C-suite leaders, administrators and nurse supervisors for its annual year-end survey. This year’s edition was conducted by email between Nov. 22 and Dec. 9.

Participation tripled over last year, when the staffing crisis was crystallizing and many facilities were facing new COVID outbreaks fueled by the emerging omicron variant. Now, many of those who work in and run nursing homes are reporting a somewhat brighter outlook and putting less emphasis on COVID-related concerns such as vaccinations and infection control.

Still, the ongoing pandemic and the potential end of the federal public health emergency and related funding are influencing providers’ actions and attitudes, said Katie Piperata, a workforce architect and former nursing home administrator who recruits for long-term care search firm MedBest.

“Their profit margins, their true profit margins without all the COVID assistance, are now worse than they ever were because the margins are so slim, if any,” she said. “I don’t see a whole lot of my clients feeling better because now they’re just feeling the true outcome of all of this.” Inflation, rising costs cut into positive outlook Broad inflation in the US economy, coupled with explosive wage hikes that won’t revert as COVID conditions wane, are putting financial sustainability front and center, Piperata added.

The McKnight’s results bear that observation out.

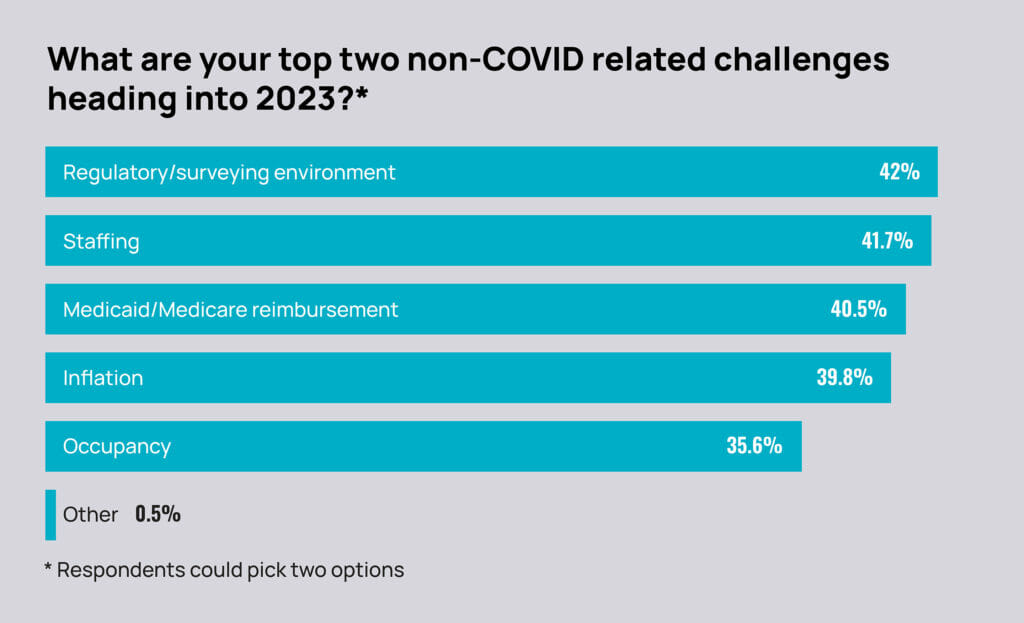

Where 94% of respondents last year picked staffing as one of their top two non-COVID concerns for 2022, that fell to just 42% in the survey for 2023. Occupancy, in second place at 44% in the 2022 survey, fell into fifth place with 36% selecting it as a top concern for 2023. For 2023, concerns among the entire responding group grew overall with the regulatory and surveying environment (42%), Medicare and Medicaid payments (40%) and inflation (36%). Among the owners, C-suite and administrators, however, 42% chose inflation as a major non-COVID concern.

“There doesn’t seem to be an end in sight in terms of the upward spiral of cost, and obviously the payment systems, especially Medicaid, have rarely, if ever, kept pace,” Lane said. “With wages skyrocketing and the added overall inflationary pressures of everything else going up, you start looking at single items — medical supplies or medications — and they’re going up more than 8 or 9%.” Lane noted that one help late in 2022 was some perceived staffing relief and connected increases in census, which can increase cash flow.

Among 633 owners, executives and administrators who responded to the McKnight’s Outlook Survey, 71% said they had already arrived at pre-pandemic census levels or expected to get back there sometime in 2023. Overall, 68% of respondents expect full census recovery by this year’s end; last year, just under 50% expected that kind of recovery by the end of 2022.

Occupancy, job satisfaction reality

But that optimism may not be truly reflective of national conditions, said Bill Kauffman, senior principal with the National Investment Center for Seniors Housing & Care. Overall, even in the nation’s top 31 metro markets, occupancy of free-standing SNFs sat at 79% in the third quarter of 2022, according to NIC Map Vision data. That’s more than 6% below the pre-COVID standard of 86.3% in those same markets.

“The skilled nursing industry is just highly fragmented, so if you’re capturing certain properties in certain areas … then they could see occupancy doing OK,” Kauffman said. “But the No. 1 concern that we’ve heard, still, is the staffing crisis. For some operators across the country, that is a direct correlation with occupancy levels.They can have the demand with hospitals wanting to refer skilled nursing patients, but they just can’t accept them.”

Despite still-arduous working conditions and persistent financial pressure — especially where staff shortages exist — both nurses and administrators reported more job satisfaction in the 2023 survey. When asked how they rate their current level of job contentment, 1 being the lowest and 10 being the highest, 298 administrators averaged a rating of 7.3, up from a 5.6 last year. Nurses’ ratings went from a 5.5 average last year to a 7.3 in the 2023 survey.

Those feeling most optimistic about the sector’s future may be inspired by conditions that lead to improved job satisfaction numbers, Kauffman said.

“You have a divide of operators. If you’re a very good operator in terms of knowing how to manage the staff, creating a culture that the staff is satisfied with and continually improving that, and also producing great quality care within your marketplace, then you can be doing well, and you will do well,” he said.

Implications of possible staffing mandate

Half of all nursing home providers and building leaders (49.8%) said they would have to close in part or in full if federal regulators adopt a 4.1-hour nurse staffing mandate in 2023. Among facility owners, C-suite executives and administrators, the predicted closure threat rose to 54.4%. Nearly 41% of that group also said they would have to hire more agency staff if that rigorous mandate is imposed.

“If it’s unfunded, all a mandate would do is cause communities to have to reach out to agencies or contract staff to meet that minimum,” Piperata said. “You might have more nurses in the building, but you can’t guarantee they’re going to be committed and have a stake in the product. If you make that a mandate, it’s only going to decrease quality because we don’t have the people.”

Many individuals running nursing homes believe they are turning the corner on extensive agency use. Last year, just 10% of respondents said they expected to reduce the use of agency staff in 2022. But in the 2023 Outlook survey, 33% predicted they would use less in the year ahead. And far fewer respondents than last year (4.7%) said they “don’t” or “won’t” use agency. That’s far fewer than the quarter (24.6%) who said this year that they don’t use agency at all.

Skilled nursing experts said that significantly increased participation in the McKnight’s survey this year might mean it better represents geographic pockets with intransigent staffing problems. It also could reflect a shifting stance in anticipation of the staffing mandate expected from the Centers for Medicare & Medicaid Services early in 2023.

More than one-third of respondents (36.2%) said they would have to hire more agency nurses if a mandate were to require 4.1 nursing hours per resident per day. That figure rose to 40.6% among administrators, C-suite decision makers and owners.

Survey shows signs of staffing rebound

Overall, staffing remains a major concern, though not quite as ubiquitously as last year’s findings revealed. In the 2022 outlook survey, 94% of respondents chose staffing as one of their top two non-COVID challenges for the year ahead. That share fell to 42% in this year’s survey.

Owners and administrators (45%), as a group, were slightly more concerned than their nursing counterparts.

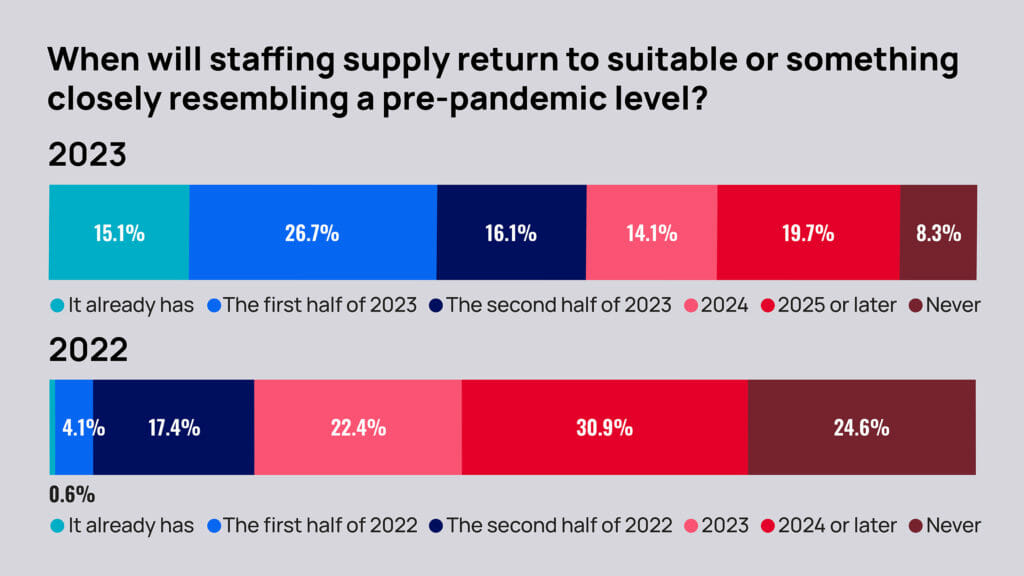

Some 58% of respondents also said staffing had already returned to “suitable” levels or “something closely resembling a pre-pandemic level” or would do so by the end of 2023.

That’s up from last year’s 22% who thought staffing levels would rebound by the end of 2022. Also on the staffing front, fewer respondents said they had to curtail admissions due to staffing and/or other COVID-related challenges in 2022. About 69% said they had to do so in 2022, down from 72.6% reporting the same for 2021.

Conversely, the proportion who foresee having to restrict admissions at any point in 2023 due to staffing or COVID in 2023 (67%) actually went up over projections for 2022 (57%).

When asked specifically about their response to the staffing mandate, 33% said they would have to close or restrict beds or units. And 17% said they would “likely have to close.” Lane thinks the numbers of projected closures may have come in too high, reflecting frustration and fears around the timing of CMS’s staffing mandate pursuit.

“The 4.1 would be crippling, very much so, for a lot of smaller providers that are single owner or the ones that don’t really have a level of support from a multi-site organization that can shift resources around,” he said. “Closing altogether? I think that is a reality for some rural providers, but I think it’s more likely to see the beds contracting a little bit.”

‘Perfect storm’ for more M&A

Regardless of the staffing mandate, nearly 40% of skilled nursing owners, executives and administrators expect they will sell some or all of their nursing home holdings in 2023. Among all respondents, including nurse supervisors, that number declines to 36.3%.

But parsing the numbers any way shows the sector is likely in for more significant merger and acquisition activity in the coming year.

Last year, providers were largely uncertain of their future plans for skilled nursing holdings, with 41.6% reporting they were “not sure” whether they would sell some, sell all or merge, hold all, acquire some or sell and acquire facilities. This year, just 11.5% were uncertain.

This year, the share of all respondents who think their organization is likely to sell all or merge quintupled from 3.79% to 19.2%. And the share likely to sell some went from 7.6% to 17.1%.

“They see what’s ahead,” John R. Washlick, a healthcare M&A attorney and transactions specialist at Buchanan, Ingersoll & Rooney told McKnight’s after reviewing survey data. He said he was unsurprised by the findings, expecting already strong mergers and acquisitions activity to ramp up as financial pressures catch up with nursing home owners who’ve been struggling to sustain operations and withstand the pressures of escalating costs.

“It’s somewhat of a perfect storm when it comes to the inflation and Medicaid and Medicare, if those rates don’t change and keep us with at least inflation. It’s really a lost battle if their rates go up and their revenue stays static,” he added. “Activity is still very robust. If someone is thinking about selling, they should be able to find a buyer.”

That outlook is bolstered by McKnight’s findings, which show 33.8% of owners, executives and administrators expecting their organizations to acquire some facilities in 2023.

But NIC’s Kauffman cautions that predictions about 2023 activity may very well be tempered by “price discovery.”

“A seller was looking at these historical prices, especially in the last couple of years. Even through COVID, those price-per-bed acquisitions were relatively high,” he said. “Some of these sellers going into 2023 might have thought that those prices were still relevant, and I would argue that there needs to be some price adjustment … especially in light of not just the challenges in the skilled nursing industry from a fundamental operational perspective, but also now with interest rates.”

Interest rate pressures resonate

Higher interest rates, overall inflation and the inability to predict what’s coming next in a volatile market are likely all adding pressure on those who may have been mulling a sale.

“The biggest challenge is the (rate) increase and the speed of the increases,” said Jim Bodine, executive vice president at investment banking firm HJ Sims. “It’s unprecedented.”

Providers used to borrowing in a historically low-rate environment were hit by seven Federal Reserve rate increases in 2022. December’s increase followed news that inflation had dropped back slightly to 7.1%, but Fed officials have indicated more hikes are coming in 2023.

In addition to operating margins that have dropped considerably, leaving less cash on hand, higher rates make it unlikely providers can borrow all they need for key capital projects — a factor experts say often leads to sales. Continuing rate hikes also have fueled ongoing talk of recession.

“We’re starting to see the effect of that on slowing the economy,” Bodine added. “That’s going to take a number of quarters to work its way through the system.”

Washlick says many are now getting their ducks in a row. He notes the ongoing pressure is especially hard on nonprofit organizations.

“If they do a 1-year, 3-year projection and they don’t think they’re going to make it, they almost have an obligation to find a buyer, particularly if it’s a nonprofit with a mission,” Washlick said. “They don’t want to abandon the residents or compromise the care of the residents. They need to go through that [exercise].”

Size, diversity deliver protection

Like Kauffman, Washlick sees great variability depending on the market. He predicts states with Medicaid reimbursements that haven’t kept pace with rising costs will see major activity this year. But he also believes organization size is an important factor regardless of a facility’s location.

“A lot of the newer operators are in that range of 10-40 nursing homes and getting bigger, and they understand the [importance] of size and the economies of scale that you get from streamlined administrative services, plus those ancillary services,” he said.

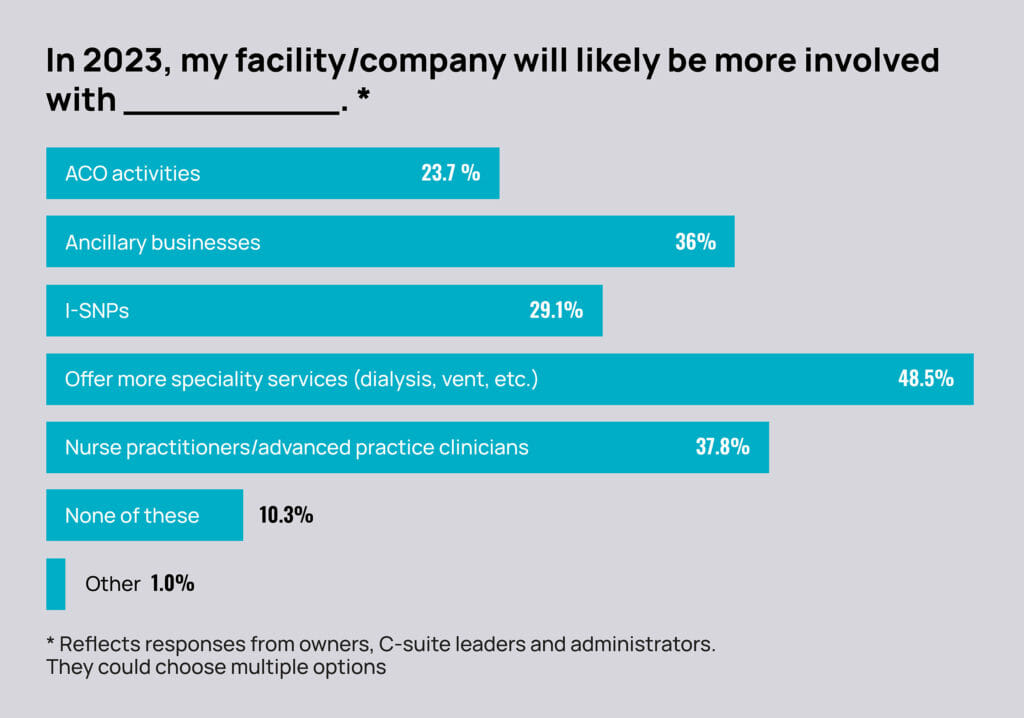

Ancillaries such as pharmacy, therapy and home health lines look attractive to a large share of McKnight’s survey respondents, with 34.4% saying they will likely be more involved with them in 2023. Respondents also said they’d be likely to be more involved with speciality services (42.6%), including dialysis, pain management and ventilator care; and nurse practitioners or other advanced practice clinicians (36.9%).

Owners and executives are also looking for opportunities in accountable care organizations (23.7%) and Institutional Special Needs Plans (29.1%) in 2023.

Respondents appeared to have a greater stake in MA programs in 2022, with 61.5% of the overall respondent group saying they were “currently participating in or have their own managed care or Medicare Advantage program,” such as an I-SNP. That was up from 43.2% reporting plan membership or ownership the prior year.

Such growth can be viewed as a way to increase referrals and revenue that can help offset losses in other areas, such as long-term care stays. But they’re also a smart move for those moving toward a sale, Washlick added.

Of course, expanding services and adding new lines of care takes investment. And in some places, that may be out of the question. Operators in states “that are not forecasting any increases in Medicaid reimbursements, they’re going to have a hard time trying to sustain and withstand the pressures of operations costs,” Washlick added. “There will be plenty of operators who will be looking for a buyer.”

From the January/February 2023 Issue of McKnight's Long-Term Care News