Providers struggling with everyday expenses and reimbursement rates that have largely failed to keep up with the costs of care plan to pursue a broad range of new revenue streams this year.

That’s according to findings from the McKnight’s 2022 Outlook Survey. It collected information from 317 nursing home owners, executives, administrators and nurse leaders between Dec. 10 and Dec. 30.

Nearly 55% percent of all respondents cited either Medicaid or Medicare reimbursements as a top concern for 2022. One-third (33%) said they expected their organizations to be more involved with managed care in 2022, with 22% expecting to see “explosive growth” in residents’ managed care selections.

“The growth of Medicare Advantage is one of the few inevitabilities in healthcare,” says Hank Watson, chief development officer at American Health Partners. “The nursing home industry has ample experience of what increased Medicare Advantage penetration means for their facilities in a fee-for-service world, such as rate reductions, collection challenges and aggressive prior authentication processes.”

Managed care jolt

Susie Mix, owner of Mix Solutions, a managed care and contract consulting firm, said it was eye-opening that only 28.4% of respondents reported more than a quarter of their patients were on managed care plans.

“I am a bit surprised that the percentage is not higher for facilities that are seeing 26 to 50% of managed care penetration in their facilities,” she told McKnight’s. “The Medicare Advantage numbers have skyrocketed in almost every state, leaving their mark on skilled nursing census.”

Medicare Advantage enrollment topped 27 million beneficiaries in 2021, representing more than 40% of Medicare enrollees, according to federal data. Mix predicts more states will see increased penetration in 2022.

“More providers are catching on that they have to become savvy with managed care,” she said. “This requires a few things. One, know your contracts. Two, continue to keep the contract updated. Three, designate one team member that is accountable for following the managed care patient throughout their stay (and) four, know how to read and maximize your contract.”

New ventures

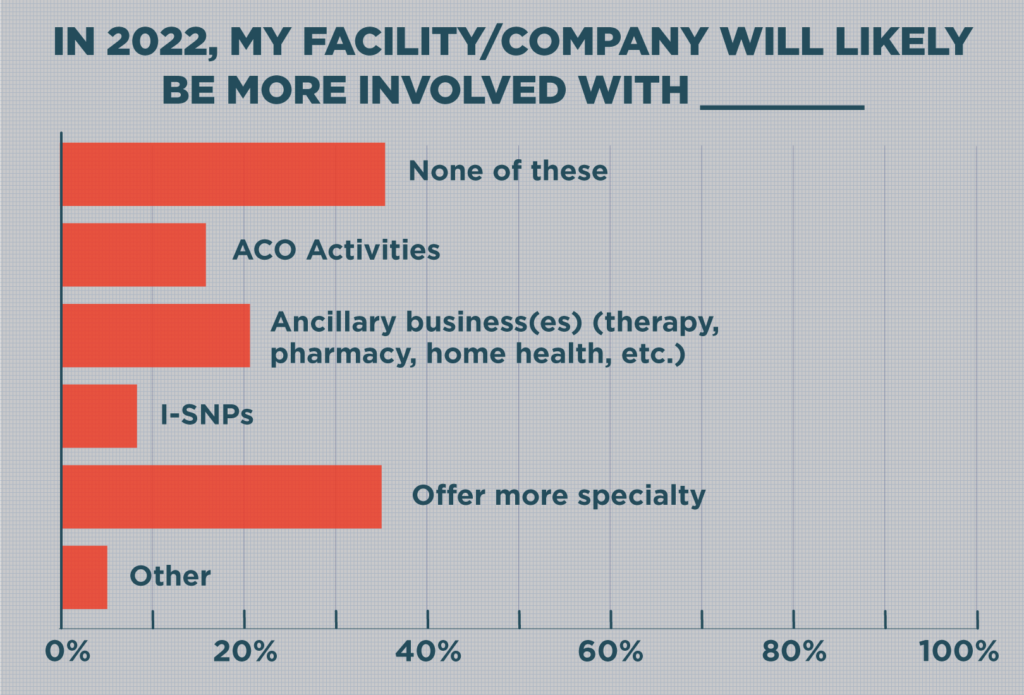

Other providers continue to pursue new revenue streams to offset lagging Medicaid and managed care rates and attract more Medicare referrals. More than three-fourths (77%) of CEOs said they are likely to be more involved in either ancillary businesses or specialty clinical services in 2022.

Another 19.2% are moving toward Institutional Special Needs Plans, or I-SNPs, possibly as a way to stave off managed care’s penetration.

“There is more committed energy around I-SNPs than I have ever seen,” said Watson, whose American Health Partners is the parent company of American Health Plans, which just expanded in Idaho and Utah and is the nation’s largest provider-owned I-SNP. “The ability for provider-owned I-SNPs to tangibly demonstrate additional clinical resources … has moved this effort past the conceptual stage for many providers.”

American Health Plans said it had reduced its members’ hospitalizations rates by 42% and shared more than $5 million in savings bonuses.

Because more providers have launched plans, Watson added, it also has become easier to sign on to an existing one in many markets — rather than invest in and build one from scratch.

“In a world filled with day-to-day operational challenges, relatively frictionless engagement is meaningful for operators,” he said.