An alarming 78% of nursing home operators and workers don’t expect the workforce to return to pre-pandemic levels for at least another year — if ever. That’s just one stark finding from the McKnight’s 2022 Outlook Survey, in which industry leaders report feeling largely pessimistic about the new year.

Leaders also remain highly concerned about rebuilding census, tighter regulatory compliance and Medicaid reimbursement rates.

McKnight’s Long-Term Care News’ garnered more than 300 responses from nursing home owners, administrators and top nurse managers between Dec. 10 and Dec. 30.

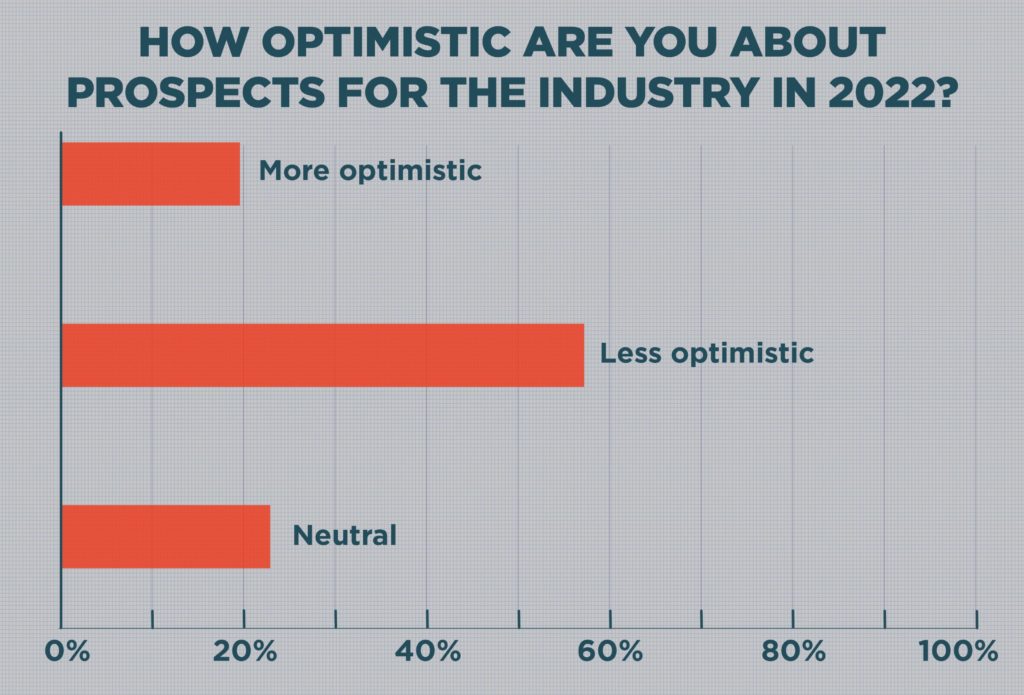

After two years of pandemic conditions, most respondents continued to be somewhat satisfied with their jobs, giving an average rating of 6 out of 10. But when asked about optimism for the industry as a whole, only 19.8% said they were more optimistic about what 2022 will have in store.

About 58% were less optimistic about 2022, and 22.4% expected more of the same next year, selecting a “neutral” outlook.

“Skilled nursing leaders no longer see the light at the end of the tunnel,” said Cara Silletto, president and chief retention officer of Magnet Culture, a recruiting and retention firm serving the skilled nursing industry. “The tunnel is getting darker and deeper. No one sees the end of the pandemic in sight. We are all asking, “How do we get out of this pandemic and workforce crisis?’ ”

Last winter, McKnight’s December survey found 88% of respondents chose “having enough staff” as one of their top four concerns for the year ahead. This year, that climbed to nearly 98%. The option was selected by every president and CEO surveyed.

Meanwhile, worries about census eased a bit in terms of urgency, with 60.6% of respondents listing it as a top four concern, versus 82% who expected it would be a major concern for 2021. Among CEOs, census was a top concern for 69% approaching 2022.

The reduced emphasis on census comes even as providers continue to struggle with occupancy. Many have had to limit admissions in 2021 without enough staff to serve all would-be residents.

“Team members in short-staffed organizations are telling their leaders that celebrating census numbers is like pouring salt in wounds,” said Silletto, a McKnight’s contributor who writes about retention strategies. “More residents without more staff is detrimental…. Keep in mind: The further we stretch our staff, the more challenging it becomes to hit compliance and quality levels we desire.”

‘Dangerous’ satisfaction numbers

Job satisfaction slipped noticeably in 2021. In December 2020, respondents reported a rating of 6.8 on a scale of 1 to 10, with 10 being the highest. That was after 10 months of pandemic conditions.

This December, that overall average fell to just 6, for a relative drop of about 12%. Satisfaction fell across all job titles, from 6.3 to 6 among owners or CEOs; from 6.9 to 5.6 among administrators; and from 6.9 to 5.5 among DONs.

Staffing experts told McKnight’s that’s dangerous territory for nurse managers and staff in other top-level positions, where shortages were intensifying in late 2021.

“I do think a ‘six’ would trigger a job change, but frankly, in my opinion, for someone in a supervisor or nursing supervisor level, it’s probably outside of the industry,” said Christina Johnson, a senior recruiter with MedBest, a Florida-based executive recruitment firm. “There are a lot of other options for a nurse obviously, and some of our competitors outside the nursing home world are offering really huge incentives like very flexible scheduling…that afford more quality of life.”

Johnson’s colleague, recruiter Katie Piperata, said much of the dissatisfaction can be tied to elements out of operators’ control.

“It’s probably that 10,000-foot view of all the inconsistency with CMS and CDC regulations coming down. It’s driving a lot of the instability for the administrator and DON, even the corporate offices,” Piperata said. “It’s really hard to rally troops and make good business decisions and build morale, when every single week, every month … there are so many changes. It’s making it really hard to not feel like you’re in a volatile environment.”

More agency staffing ahead

Piperata predicts additional losses during the year ahead. Many nursing home workers, she said, were trying to wait out the pandemic but will have now reached their limit after nearly two years under a public health emergency.

And that has implications for other 2022 challenges survey respondents are concerned about. Chief among those is increased reliance on contract and agency staffing.

That could actually be worsening, according to respondents.

About 39.4% said they expect to use more temporary staff in 2022, and another 26.2% said they would use the same amount. Another 9.8% expect to use less, while 24.6% of respondents said they do not or will not use contract or agency workers.

Meanwhile, worries about tighter compliance and more regulation came in as the third-most common top concern, with 56.8% of respondents choosing that option. The Centers for Medicare & Medicaid Services said in late 2021 that it planned to place a renewed emphasis on routine surveys, while officials also will be looking for continued compliance with infection control standards that have taken center-stage since the pandemic started.

Meeting state and federal standards consistently becomes a challenge in facilities that are short-staffed and continually dealing with turnover and temporary agency staff.

“Effective onboarding will become a critical component success factor this year,” Silletto said. “Organizations will need detailed onboarding checklists (so) as not to overlook important training, mentoring, and team building. Checklists are more important for consistency in times of high turnover.”

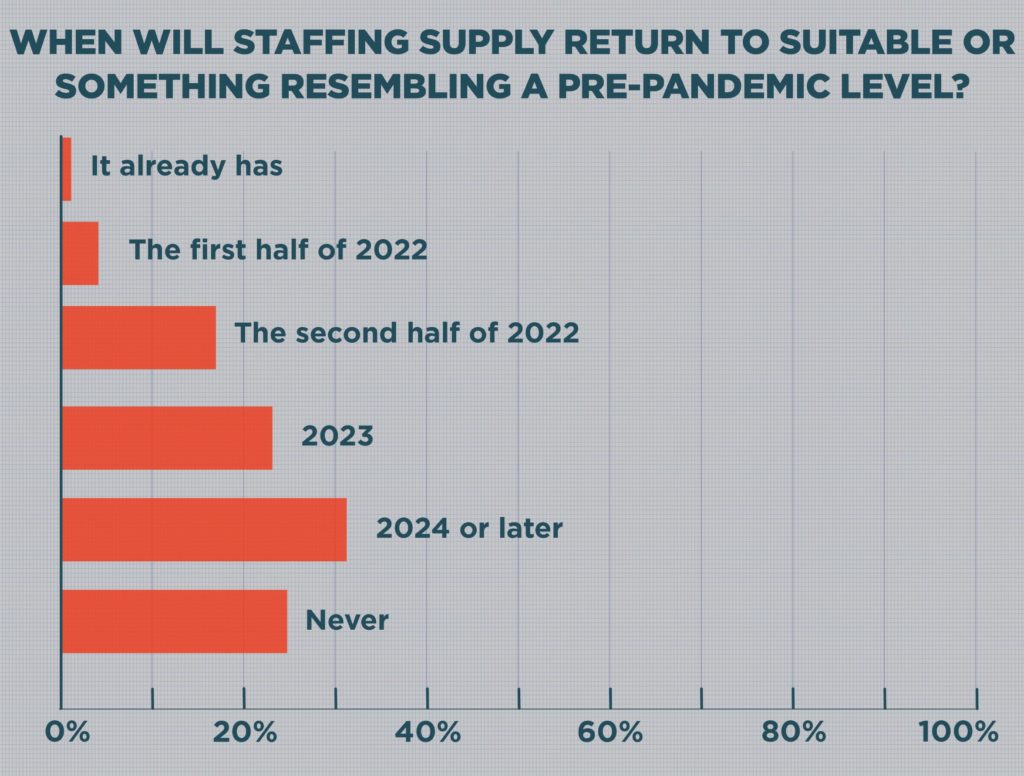

As for how long the staffing challenges will last, providers aren’t optimistic. Only two individual respondents said their staffing was at a pre-pandemic level. About 21.5% thought they’d get back to full staffing levels sometime in 2022. But more than two-thirds envision labor shortages lasting longer. About 22% predicted a 2023 recovery, while 30.9% said 2024 or later.

Another 24.6% said the staffing supply would “never” return to a pre-pandemic baseline, given losses of 425,000 industry employees since February 2020.

Piperata is more optimistic long-term.

“I do think it is seasonal. I just don’t know how long the season will be,” she said. “We always bounce back. The period of time it’s going to take to bounce back … I think it’s really going to be driven by regulation and governmental agency and some consistency.”