A federal regulator that rarely intervenes in nursing home practices on Thursday issued a firmly worded letter to nursing homes and collection agencies, ordering them to stop the use of certain strong-armed financial practices at admission.

The Consumer Financial Protection Bureau said a nursing care facility “may not require that a third-party caregiver personally guarantee payment of a nursing home resident’s bills” as a condition of admission, noting that such a contingency violates the Nursing Home Reform Act.

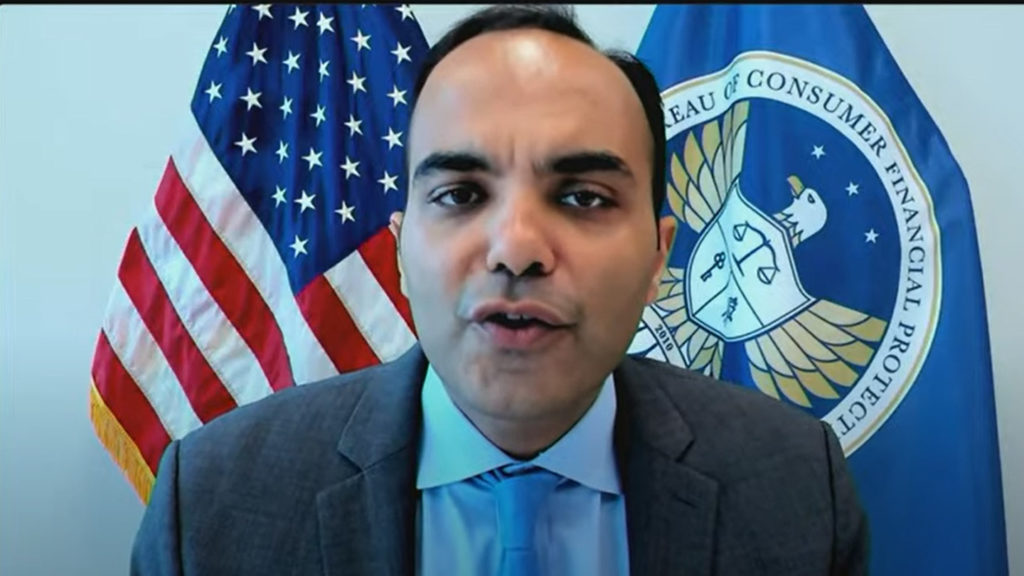

At a virtual field hearing Thursday afternoon, CFPB Director Rohit Chopra encouraged families to file complaints with his agency and at the state level. Chopra also asked nursing homes to “confidentially inform” state or federal enforcement agencies about the illegal practices of others to help “address the range of harms associated with medical debt,” he said.

Chopra noted that he has for years heard from law-abiding nursing home operators who said they were disadvantaged by having to compete with those who “engage in exploitative tactics or otherwise break the law” regarding financial requirements at admission.

The increased CFPB attention to the issue follows a recent media investigation that outlined some nursing homes’ predatory practices of securing agreements from and then relentlessly pursuing relatives and friends over bad debt.

CFPB said it had received similar complaints.

“Caregivers have been subjected to wage garnishment and have even lost their homes after being pursued by nursing homes for debts associated with family members’ or friends’ costs of care,” the agency reported in a series of related documents Thursday. Related court actions are rooted in clauses used in admission contracts that require caregivers to be a “responsible party” for a resident’s costs of care.

Nursing facilities that violate the nursing home reform act can be subject to enforcement action by state agencies and by the Centers for Medicare & Medicaid Services, whose director co-signed the joint letter sent to nursing homes.

‘Appalling and outrageous’

During the hearing, Carol Silver Elliott, president and CEO of Jewish Home Family and immediate past chair of LeadingAge, said her community works closely with residents and family members to make sure they understand admissions agreements and financial power of attorney. Bad debt, though, is part of the “nature of the beast,” she said.

“We have to support our organization. We have to be able to pay our staff … That being said, there is no reason for unscrupulous or deceptive practices in the way we collect,” Silver Elliott said. “There is absolutely no reason, quite frankly, to be suing people who are disconnected from this care. It is appalling and outrageous.”

While CFPB does not enforce the Nursing Home Reform Act, it said that admission contracts that violate the Act’s ban on requesting or requiring a third-party guarantee of payment are unenforceable. Subsequent collection of debts based on those contracts may violate consumer financial protection laws such as the Fair Debt Collection Practices Act’s prohibition of “any false, deceptive, or misleading representation or means in connection with the collection of any debt.”

The CFPB does enforce that act. And the agency explicitly said nursing facilities in the Medicare or Medicaid program are subject to the Act’s prohibitions on asking a caregiver to guarantee payment as a condition of admission, expedited admission, or a continued stay.

Debt collectors may also violate the Fair Credit Reporting Act by furnishing information about those invalid debts to consumer reporting agencies, CFPB said.

Attorneys who testified during the field hearing cited widespread and routine use of such admission agreements and high-pressure collection tactics in multiple states, with one alleging that some nursing homes bring cases for thousands of dollars against “people who did not owe the debt.” Those sued sometimes pay the debt; others have had bank accounts frozen or wages garnished.

Chopra said his agency would be increasing its oversight of nursing home collections and other nursing home financial issues through its dedicated Office for Older Americans. He also noted in opening remarks the focus the Biden administration has placed on private equity investment in nursing homes, adding that he wanted to better understand its financial effect on residents and their loved ones.