(Fourth and final in a series on providers’ attitudes and concerns about operating conditions in 2023.)

More skilled nursing providers are embracing Institutional Special Needs Plans by joining existing programs or creating their own as enrollment in other Medicare Advantage plans threatens to surpass half of all Medicare beneficiaries in 2023.

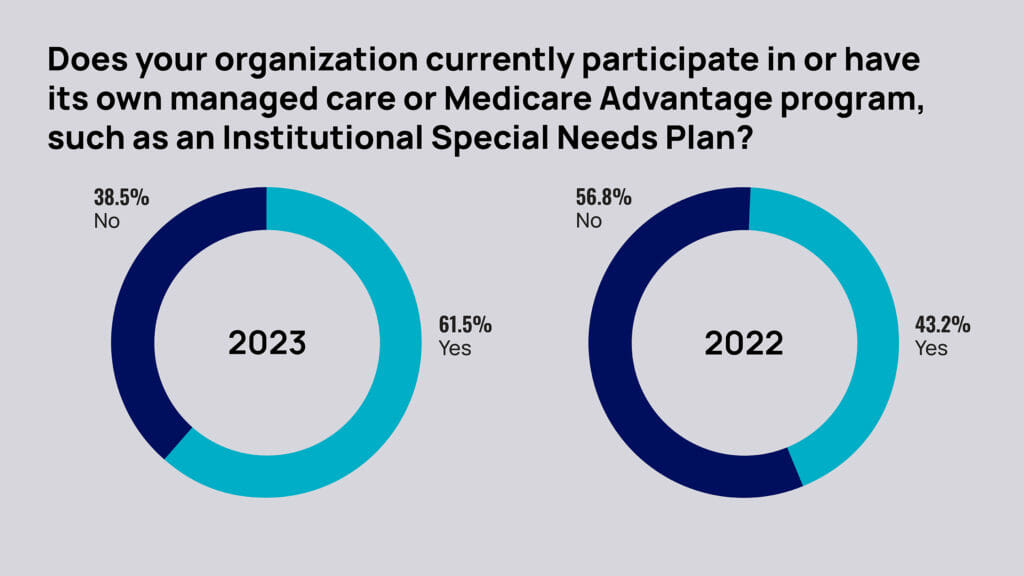

The McKnight’s 2023 Outlook Survey found 63% of responding owners, executives and administrators said their organization currently participate in or have their own managed care or Medicare Advantage program, such as an Institutional Special Needs Plan (I-SNP).

Last year, some 55% of owners told McKnight’s they expected to be “more involved with managed care” in 2023. This year, that fell to 38%. But the newer figure may reflect a leveling off after a bellwether year in 2022.

“There’s probably more focus on I-SNPs and our model than there ever has been before, so it’s a very encouraging time,” said Marc Hudak, chief growth officer at Longevity Health Plan, which has more than 30 operating partners and about 5,000 members in I-SNPs in nine states. “They align very well with CMS’ push to having value-based care be the centerpiece by 2030.”

An increase in I-SNP activity now makes sense, as providers look for relief from regulatory and reimbursement pressures after years years focusing on daily operations during COVID.

“People have a little more time to pick their head up and think a little bit more about the future,” Hudak said. “Secondly, there’s an ongoing evolution of more and more people moving to Medicare Advantage plans. We’re close to 50%. There’s a very material payer mix shift, which means compressed rates, which means more prior authorization, concurrent stay reviews … really pressure on a key line of business that historically has performed very well for skilled nursing facilities.”

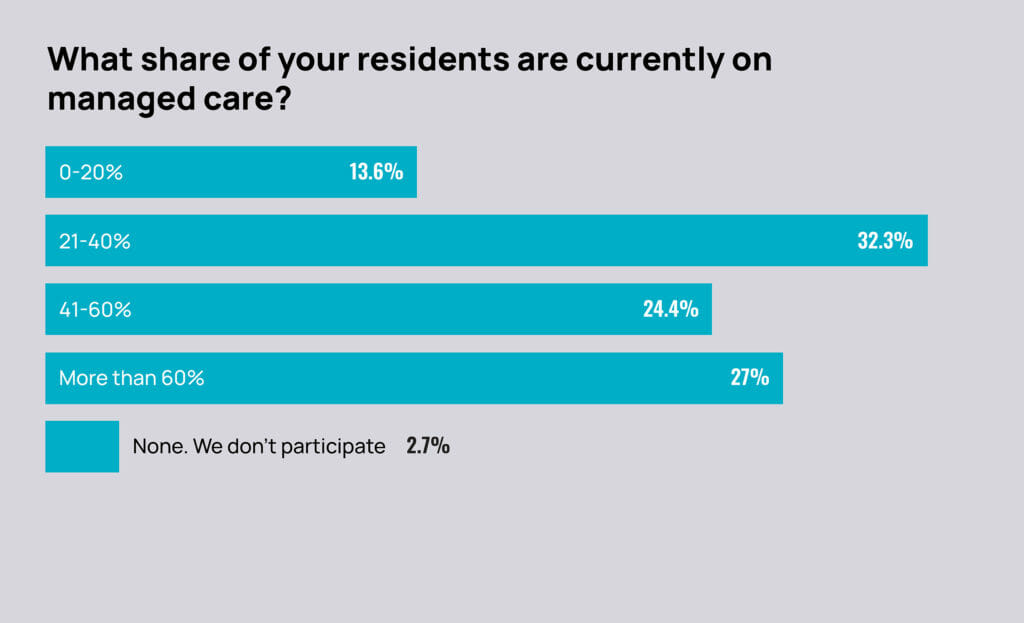

Just under 28% of owners, C-suite leaders and administrators told McKnight’s that more than 60% of their residents are currently on managed care. Another 55% said they had 21% to 60% of residents on managed care.

Also this year, 15% said they had less than 20% on managed care. That level is less than one-fourth of the 2022 survey’s levels at that low level of involvement.

Among all respondents, about 64% expect to see “explosive” or more “small” growth in Medicare managed care plan selection this year.

The 2023 Outlook Survey was conducted by email from Nov. 22 to Dec. 9. McKnight’s Long-Term Care News garnered nearly 1,000 responses from nursing home owners, C-suite leaders, administrators and nurse supervisors for its annual year-end survey.

Even as data reported by NIC in late December showed skilled nursing occupancy rates at 79% — the sector’s highest level since April 2020 — Medicare Advantage trends are dampening excitement about long-term recovery.

“Some operators see an opportunity to capture patient volume with the growth of managed care, depending on the operator’s business model,” wrote Bill Kauffman, senior principal at the National Investment Center for Seniors Housing & Care.

His blog noted that Managed Medicare revenue per patient day for October 2022 was down 1.4% from a year earlier and down 4.7% from October 2020.

”The continued decline in managed Medicare revenue per patient day can pose a challenge to operators,” he wrote. “Medicare fee-for-service RPPD ended October 2022 at $583 and managed Medicare ended at $465, representing a $118 differential. In October of 2020, the differential was $100.”

Given reimbursement pressures from regular MA plans, which have traditionally also steered more patients to home care as an alternative to skilled nursing, it makes sense for providers to seek partnerships that pay better and provide tangible support, Hudak noted.

Under I-SNP plans, participating facilities can take advantage of advanced practice clinicians, social workers, telehealth specialists that are all intended to improve outcomes and reduce their overall costs on the way to earning incentive payments.

And they’re not the only option for providers looking to protect and grow revenue streams.

Ancillaries such as pharmacy, therapy and home health lines also look attractive to a large share of McKnight’s survey respondents, with 34% saying they will likely be more involved with them in 2023. Significant numbers of respondents also said they’d be likely to be more involved with speciality services (43%), including dialysis, pain management and ventilator care; and nurse practitioners or other advanced practice clinicians (37%).

PREVIOUS COVERAGE OF THE 2023 OUTLOOK SURVEY: ‘Perfect storm’ of inflation, low reimbursement to drive mergers and acquisitions; Providers warn of broad closures, agency reliance under possible staff mandate; Spiraling costs threaten growing optimism for skilled nursing