Managed care plans typically hold all the cards when it comes to rate-setting. But a new way of analyzing billing data could finally give increasingly leveraged providers a better leg to stand on, financial experts say.

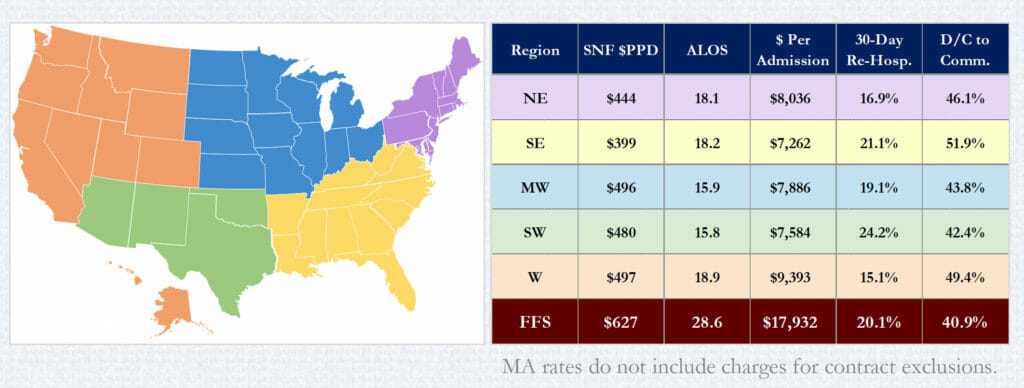

The new analysis breaks out the data by per diem rate, length of stay, revenue per admission, and outcomes per 30-day rehospitalization rate, as well as discharge to community rates for Medicare Advantage participants. It is based on 24,000 Medicare Advantage episodes during the half-year period ending Aug. 31, 2021.

The data provides benchmarks using managed care claims instead of fee-for-service claims and helps fill in a “black hole” of data, said Marc Zimmet, CEO of Zimmet Healthcare Services Group. It is the parent organization of CORE Analytics’ Medicare Advantage Post-Acute eXchange (MAPAX) program.

It is not uncommon for top performers to be denied commensurately better reimbursements because of “an asymmetric information flow,” Zimmet explained.

“Providers have no support to call up a Medicare Advantage company and say, ‘Our episode costs are this and our quality is this and we’re charging $2,000 less than anyone in our neighborhood … we want a rate increase.’ That dynamic doesn’t exist.”

MA plans continue to make huge inroads into skilled nursing, averaging 40% nationally and as high as 60% in some places.

The “look under the hood” at MA utilization data is unprecedented, Zimmet said. It draws on data from nearly 1,300 of CORE’s roughly 3,000 clients thus far.

The benchmarking taps down to the county level, though the new data release charts it by national regions.

States in the West ($497) and Midwest ($496) registered the largest per diem rates, while the Southeast ($399) was lowest. That’s compared to the fee-for-service national average of $627.

On the revenue-per-admission scale, the West ($9,393) far outpaced the next regions (Northeast, at $8,036) and Midwest ($7,886). That was still barely more than half of fee-for-service’s average of $17,932.

The best 30-day rehospitalization rates also were in the West, Northeast and Midwest — 15.1%, 16.9% 19.1%, respectively — compared to 20.1% for FFS.

The highest average length of stay was in the West (18.9%), followed by Southeast (18.2%) and Northeast (18.1%) while the Southwest (15.8) and Midwest (15.9) were the shortest. The national fee-for-service ALOS was 28.6 days.

Some of the stark differences point out why providers can benefit from having fuller data sets to analyze, said Zimmet.

“It’s the first information that allows a nursing facility to compare, to see how they’re doing with respect to utilization episodic revenue, to how they’re doing with respect to their peers in MA programs,” he explained. “MA plans are not going to like this at all. With SNFs in the dark, facilities can’t use their own quality to push for better terms.”

Standard “Limited Data Set” claims-submissions data is about nine months old, Zimmet points out, while MAPAX’s is current, organizers say.

Zimmet explained that a provider could be more efficient and provide far greater value than anyone else in the county but still receive lower reimbursements

“The concept there is you go to the insurance company and they don’t take your call. You go to them with the data and if you’re that much better, they’re going to give you that rate increase,” Zimmet said. “We’ve seen it. Because they can’t afford to lose you.”

“The thing that is so resounding, really, is the fact there is very little, almost no correlation with quality to the revenue component,” noted CORE Chief Operating Officer Vincent Fedele. “So, we ran regression on seeing if the higher-paid providers have better outcomes, like rehospitalization rates and Five-Star and that kind of thing. And there just isn’t. It really just hammers the point home that people haven’t had access to information and aren’t leveraging it to improve their position.”

Adds Zimmet: “It’s critical that facilities improve their position and their structure with Advantage plans, and you can’t do that when the insurance companies have all the data and you have nothing. You have no idea what your neighbor is doing.”

It’s huge already, but Medicare Advantage is going to be an even bigger threat to facilities as younger beneficiaries age out and start to receive skilled nursing care, Fedele said.

“As this continues to get worse and worse with the penetration and the continuous erosion of the Medicare fee-for-service census, this is going to be a bigger deal in the next three years,” Fedele said. “There’s no data to have a strategy on this. It’s a gap we’re trying to fill.”