The following is the second of three articles in a series:

In last month’s blog we presented a bold statement: “The healthcare industry is faced with critical investment decisions that may very well determine if businesses within the industry will remain relevant.”

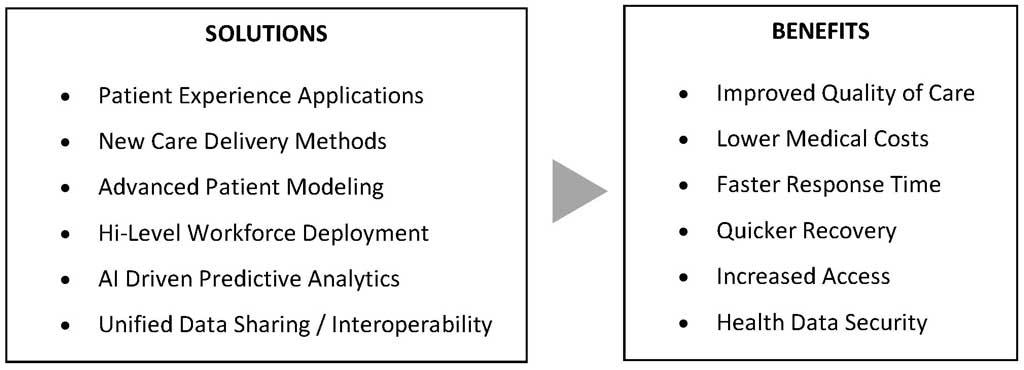

Value-based reimbursement is driving innovative advancements in new technologies and solutions reference below. Many of these solutions individually require significant capital investment, and the aggregate potential investment often represents an unprecedented level of capital commitment.

The introduction of so many new technology-driven solutions is requiring healthcare providers to spend more resources than ever seeking answers to such questions as:

- Which new solutions do we fund?

- How does the perspective capital investment impact the company’s enterprise value?

- What is the anticipated impact on value if we don’t make investments in new technologies/ solutions?

- Do we fund new solutions via direct investment or acquisitions?

- Do we sell or merge our company with another entity which already owns the new solutions required to support our growth?

Assessing CapEx ROI

There are typically three main reasons for committing to capital investments:

- Expansion, (e.g., increased productivity, create new offerings)

- Increase efficiency and reduce costs

- Replace existing obsoleted and/or end-of-life assets

Regardless of the reason for making the capital investment, the financial evaluation process can be quite complex. As a result, the capital budgeting and analysis process represents a significant revenue stream for many well-respected global consulting firms.

A good consultant will work closely with the client to ensure, among other factors, that estimates of cash flow timing are credible; anticipated costs of capital funding are reasonable; and all sources of cash flow are accounted for, including changes in working capital (e.g., receivables, payable, inventory, etc.) and revenue and direct costs implications.

The fundamental steps involved with the ROI analysis are:

- Determine the total cost (i.e., direct material, labor, utilities, space requirements, implementation, etc.)

- Determine the total benefit (i.e., revenue, production costs, productivity, quality of care, reputation, etc.)

- Calculate expected return (requires cash flow proforma of the project)

- Evaluate the risk that the asset will not achieve the return

- Compare the expected risks and return against alternative investments

Assessing the impact of CapEx investment on enterprise value

The foregoing ROI analysis is complex enough. Now imagine your board trying to assess how the proposed capital expenditure impacts your company’s enterprise value, and the implications to a potential merger, acquisition or potential sale of the business! How about, as mentioned in our prior blog, analyzing the financial implications of acquiring a company which has already made the requisite capital investments; or alternatively, merging or selling the company, thereby shifting the cost of these investments to a partner or acquirer.

This requires one to embed all the cash flow variables resulting from the potential capital expenditure analysis into each corporate valuation methodology utilized (i.e., asset, market, income) to determine the enterprise value. At a minimum, two valuations should be performed: one valuation to determine the enterprise value prior to the proposed capital investment (which must also account for the risk of not making such investment) and a second to determine the enterprise value after the proposed capital investment.

We recommend that prior to committing to any material capital investment, every company should first answer the question: What will be the impact of such capital investment on our Company’s enterprise value?

For family-owned businesses, the answer to this question can be life-altering. For public companies, both large and small, an incorrect assessment can lead to a material decrease in market capitalization or even jeopardize the CEO’s position. Here we have a bit of a conundrum. Rarely, if ever, does the company (private or public, large or small) have the internal resources to answer this question.

Next month’s blog will discuss how to assess the impact of a potential CapEx investment on the value of the enterprise.

Let’s start a discussion. Please share your thoughts.

Scott Waxler is managing director of LockeBridge Capital Partners, a leading middle market M&A advisory and investment banking firm with strong credentials in medical device, healthcare IT, healthcare facilities, and services and pharma/biotech. Scott has won numerous prestigious awards including the M&A Advisor’s Deal Maker of the Year Award.