With all of the day-to-day pressures to thrive in today’s rapidly changing environment, it might seem that to voluntarily add a challenge, such as bundling, provides few benefits.

Bundling is complex, potentially financially risky, and in the case of post-acute care providers, savings are typically achieved in part by lowering utilization of services, which may pose further financial strain. Participation in the Bundled Payment for Care Improvement (BPCI) Initiative, however, creates three clear and compelling strategic advantages for PAC providers to consider: (1) Data Enlightenment, (2) Experience in Risk-Based Payment, and (3) Market Positioning.

So, before PAC providers allow an already crowded list of to-dos and the notion of risk to make the decision to sit this one out, providers should give participation in BPCI serious consideration as a tool to move toward the future imperative of value-driven healthcare.

Let’s reflect on bundling in the broader context. Why is CMS focused on bundled payment generally and why specifically post-acute care?

In a nutshell, PAC represents a substantial proportion of total Medicare spending, is growing quickly, and is responsible for a majority of the geographic variation in Medicare spending. Skilled nursing facilities (SNF) and home health agencies (HHA) represented a growing 16% of total Medicare FFS spending in 2012.[1] PAC also contributes substantially to geographic variation. The Institute of Medicine concluded in a July 2013 report that, “[i]f there was no variation in PAC spending, variation in total Medicare spending would fall by 73 percent.”[2]

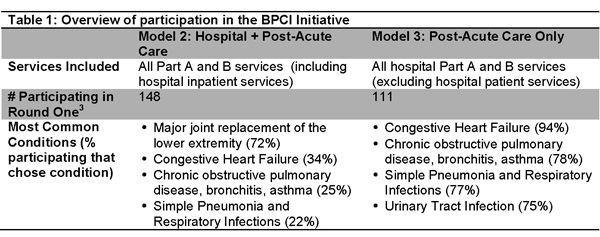

In response to these challenging dynamics in post-acute care, the Centers for Medicare & Medicaid established the BPCI Initiative, which tests bundled payments to align incentives for providers to coordinate care across multiple clinical conditions and care settings. Of the four models that CMS created, PAC providers can participate in Models 2 and 3. Episodes of care in Model 2 begin with and include an inpatient stay in an acute care hospital, while episodes in Model 3 do not begin until after the hospital stay at the initiation of post-acute care services with a participating long-term acute care hospital, inpatient rehabilitation facility, skilled nursing facility, or home health agency. For both models, participants determine whether the episode duration is 30, 60, or 90 days and select up to 48 different clinical condition episodes. Payments are retrospective.

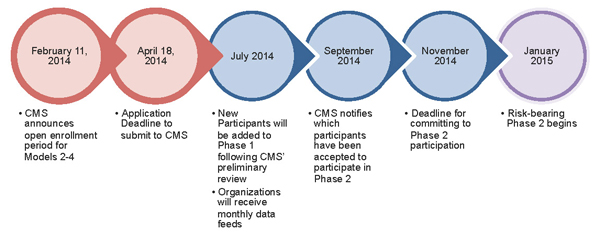

In February 2014, CMS announced a new opportunity for PAC providers to participate in Models 2 and 3. The deadline for applications is April 18, 2014 (see the figure below).

So, why should PAC providers consider adding this to an already crowded day-to-day existence? There are three strategic advantages which providers should strongly consider when deciding whether or not to pass up the opportunity to participate in a bundled payment structure:

- Data Enlightenment. First, participation grants access to historical Medicare claims data. Such access offers providers the ability to evaluate, interpret and translate the data into better patient care and improved clinical opportunities. This “enlightenment” from the data will lead to better opportunities for improved quality and inform strategic goals in an environment where fee-for-service payment is less prevalent.

- Experience in Risk-Based Payment. Second, bundling participants gain experience in risk-based payment while experimentation is still allowed. CMS is awarding BPCI participants with the ability to experiment and design which clinical conditions to include in their bundles and for how long (i.e., 30, 60, or 90 days). More experience now, when the risks are not as great, offers leverage for success under future bundling structures.

- Market Positioning. Third, early participation in risk-based payment models enables providers to better position themselves in the market and build relationships with referring hospitals and physicians. PAC providers can build trust and relationships by aligning incentives with referral partners who are also bearing risk for the cost and quality of patient care. The better the relationship PAC providers have with these upstream providers, the more likely they are to become “preferred” partners.

Those post-acute care providers with a strong strategic rationale—including experience with risk-based payment, market leverage and testing models of coordinated care—are the most likely to move forward with BPCI. Not participating means missing out on a unique opportunity to help determine the care management and care redesign needs of the future, as well as define the infrastructures needed to effectively manage costs, quality, and patient outcomes among multiple providers, all of which will be necessary to thrive in a future, value-driven world of healthcare. Be sure you carefully consider these advantages before you choose to watch this one from the sidelines.

Brian Fuller is a director at Avalere Health, and specializes on care integration and partnership development across the continuum, including evaluating and implementing new payment models such as bundled payment and ACOs.

[1] MedPAC, “June 2013 Data Book: Health Care Spending and the Medicare Program,” (p. 3), 2013.

[2] Institute of Medicine, “Variation in Health Care Spending, Target Decision Making, Not Geography,” July 24, 2013.

3 Number of participants obtained from Data.CMS.gov, Accessed April 14, 2014.