Variation and growth in post-acute care spending has earned PAC a spot on hospital and health systems’ priority list for cost-saving opportunities. The success of new care delivery models — particularly hospital-driven bundles and accountable care organizations — also is dependent on reduced utilization and episodic cost management in non-hospital settings. These payment dynamics have driven more and more hospitals and health systems to act as gatekeepers to PAC in order to better manage risk. Whether or not your community hospitals are currently focusing on PAC as a top priority, partnership and network strategies are emerging issues that need to be understood and addressed.

To influence and monitor utilization and costs beyond hospital walls, hospital-led ACOs, among others, are developing continuing care networks of skilled nursing facility and home health agency providers to deliver high-quality care, leverage clinical expertise, and improve efficiency, patient outcomes and the patient experience. While dependent on market characteristics, many PAC providers have already experienced some movement towards CCNs and recognize the contractual and financial implications of these “preferred” or “narrow” PAC networks.

There are two common approaches to developing a CCN. The easier of the two is for the hospital to identify historically high-volume referral facilities as members of the PAC network. Without a more deliberate approach to establish the necessary infrastructure and align goals and incentives for providers in the network, however, the hospital can expect in the future to experience similar quality outcomes and Medicare spending results as it has in the past.

Alternatively, a hospital can pursue a more strategy-driven approach by assessing the value of potential partners, which requires determining the need for specific PAC services, devoting the resources to supporting their network and working collaboratively with network members to redesign care. This approach requires a more intensive assessment of where current patients are going, how patients can be better cared for and how the hospital and post-acute care network providers can better work together to achieve mutually aligned goals in the future.

A hospital’s partnership strategy is often indicative of the hospital’s culture and PAC assets. Yet, whether a hospital controls PAC assets or is more likely to work with affiliated partners, CCNs have a role in varying structures. Regardless, community providers are necessary members of a complete PAC network and inclusion results in increased volume from the hospital partner once the network is established.

CCNs are an imperative for optimal success for a hospital or other upstream player at risk for care delivered across the continuum. Furthermore, early results from ACOs and bundled payment organizations with formalized CCNs signal positive outcomes: improved transitions of care and information exchange; lower readmission rates; lower SNF length of stay (LOS); and innovative complex care management initiatives. PAC providers then should prepare to be assessed for initial and continued inclusion in a narrowing network, which will require several key strategies in order to be positioned as a strong market partner:

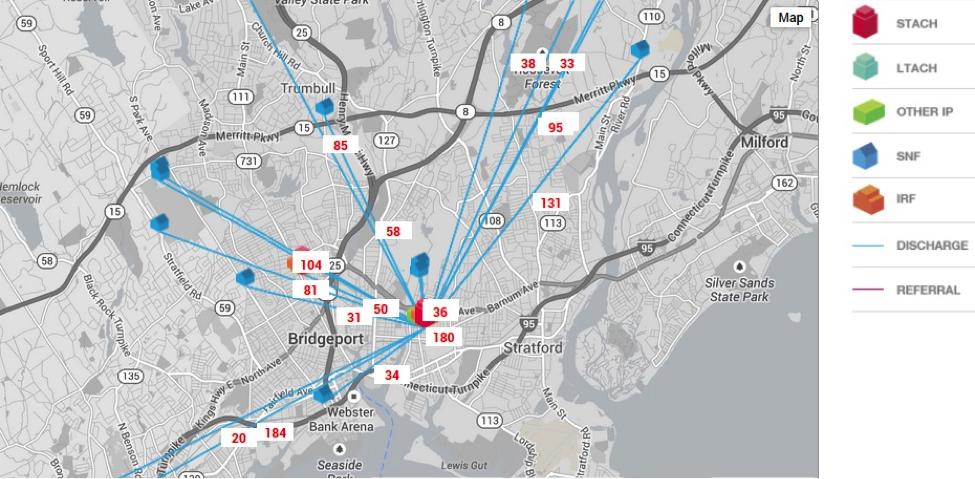

1. Know your market share and anticipate changes: Know where your community hospitals are discharging to and how your current market share might change. The following graphic illustrates one way to track your community hospitals’ discharge patterns and anticipate your facility’s market share. This graphic shows the number of discharges from an acute-care hospital to SNFs in the market.

2. Understand the evaluation metrics and invest in data analytics: Prepare to discuss key metrics that hospitals and health systems use to evaluate partners—referral patterns, readmission rates, nursing staff ratios, and LOS. Demonstrate your facility’s expertise and infrastructure to report data to hospitals on an ongoing basis. Use your facility’s other capabilities (e.g., patient/family satisfaction measures, tools to support care delivery, care protocols, availability of therapy, physician and nursing (Advanced Practice Nursing and Registered Nursing) coverage & clinical skills, etc.) to better position your facility in partnership conversations.

3. Communicate your willingness to collaborate to achieve shared goals: Demonstrate your facility’s openness to collaborating with the hospital or ACO. Collaborating to identify areas to improve patient care across the continuum also helps your facility understand and anticipate the immediate and long-term goals of the partnership.

4. Explore ways to clinically integrate: Explore integration at multiple levels with the hospital. For example, integrate at the service line level around a specific clinical condition or align your facility’s physician model with the hospital’s physician network.

Even if your facility is initially selected into a narrow PAC network, expect to be continuously evaluated and create your strategies knowing that every other competitor in your market is also working to consistently improve their market position. Those providers that are able to effectively illustrate a strong market position today and continue to improve their capabilities and performance will be those that become and remain the key partners selected in a narrowing PAC network.

Brian Fuller is a director at Avalere Health.